Are “Normal” Oil Conditions within Sight?

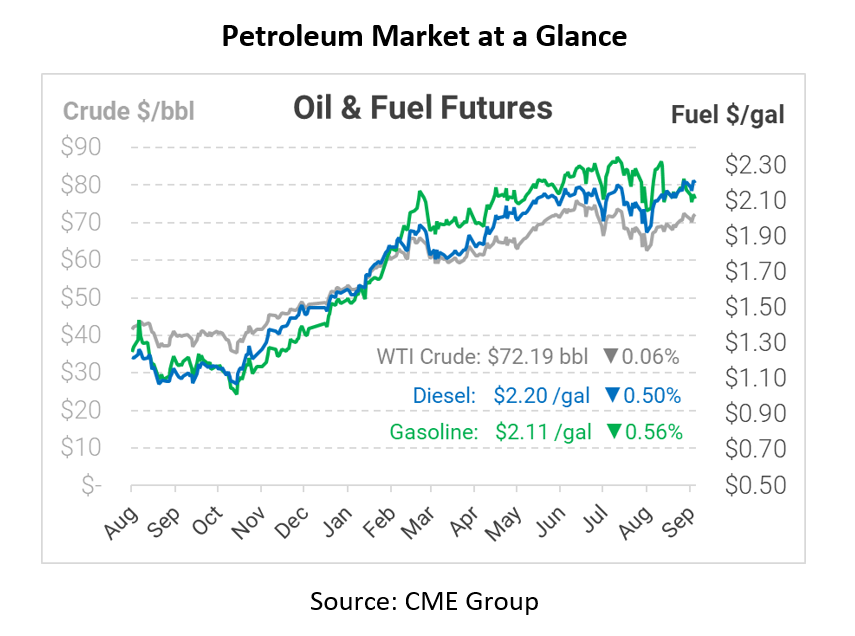

Today oil prices let up slightly, but still remain above the $72 dollar mark. Crude oil opened the day at $71.97, while diesel opened at $2.2110 and gasoline at $2.1164. These prices result from growing demand for fuel and a U.S. crude inventories draw that has been impeded by the two hurricanes we saw this month in the Gulf.

After all the market has been through with the pandemic and with storm season affecting fuel prices, things seem to be moving upward. Overall fuel demand has now been restored to pre-pandemic levels, where supply has come in at almost 21 million barrels per day. This is not far from 2019’s pre-pandemic numbers. With oil production continuing to come back online in the Gulf, output will continue to rise even more. Yesterday BP said that all four of their offshore rigs have resumed operations after they were halted for a long period of time during the Ida recovery efforts. The demand for oil continues to ramp up quickly as people are trying to get back to normalcy and more comfortable leaving their homes now.

People are starting to feel safer, which means they are more likely to travel. Inherently this is sparking a global fuel demand increase. This week new reports from the CDC showing Covid-19 cases declining made headlines. While officials say to not let your guard down, many can rest easy knowing that there is hope when talking about Covid-19 and new cases. One worry for health officials is winter just around the corner, where sickness is rampant during that season. As people continue to get vaccinated and for some even getting booster shots, one thing remains clear: With oil supply and demand starting to reach normal numbers, there is a very positive outlook going forward.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.