Oil Bulls Are Exiting Market, Prices Prove Resilient

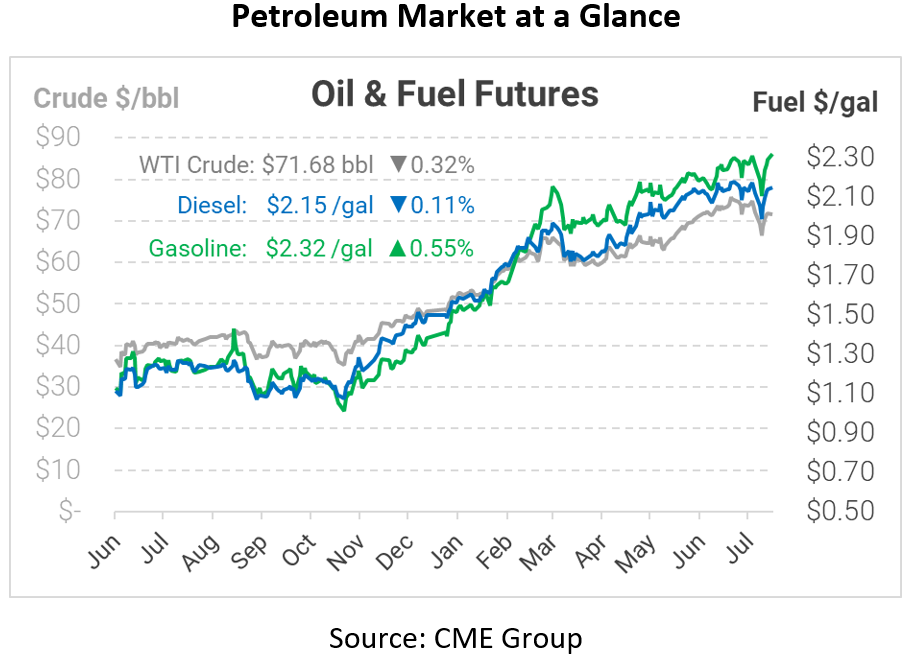

In the absence of news, oil prices are continuing a choppy sideways trade, with brief surges up and down but no clear trend. Federal officials are reportedly reviewing the need for updated mask guidance. The CDC tightening its mask recommendations could renew consumer fears of exposure, which could, in turn, dampen demand.

Although market prices have held relatively stable, enthusiasm has waned a bit. Reuters reports that hedge funds have begun unwinding their oil hedges, taking their profits and exiting the markets. Last week, money managers sold 172 million barrels of oil and oil products, the highest volume since July 2018 and the sixth highest since 2013. While the case for higher oil prices still stands, COVID variants have muddied the water. On the flip side, it’s notable that prices have held relatively steady as money managers withdraw; if the tide turns and money managers return to the market, it could trigger a quick, sharp increase in prices.

Looking ahead, oil prices continue showing steep backwardation, meaning that future prices are lower than current levels. For WTI crude, 2022 crude oil prices are trading around $63, while 2023 average prices are closer to $59. That steep drop continues incentivizing oil suppliers to pull from inventories, which causes short-term prices to increase. Usually, a backwardated market incentivizes higher production, which eventually moderates costs. However, US producers are staying on the sideline to focus on financial discipline, leaving OPEC+ to dictate rates. That’s why OPEC’s decisions have been so important recently – if they don’t raise output, crude markets will remain undersupplied and prices will keep rising. Their 400 kbpd increase will help balance the market, but still leaves an imbalance that will be filled by global inventories.

This article is part of Daily Market News & Insights

Tagged: COVID, Market Prices, Oil production, Variants

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.