Why Everything Is Getting More Expensive – Freight, Fuel, & DEF

It seems like the price of everything is going up recently – goods, labor, fuel, even freight prices. In the post-COVID economy, prices are rocketing higher. Some of the statistics you hear lack meaning: consumer prices rising 5% since the bottom of the world’s worst recession isn’t exactly frightening. But in other cases, the rise in undeniable. For instance, fuel prices have rocketed past pre-COVID levels, with analysts increasingly pointing to a $100/bbl target sometime in the next year.

Today, we’ll look at three specific areas impacting the downstream fuel landscape: freight, fuel, and DEF.

Why Freight Prices Are More Expensive

Although the driver shortage has been an ever-present threat for the past several years, it’s now gained teeth. Amid a broader labor shortage, freight companies are struggling to hire enough drivers to keep pace with demand. The American Trucking Institute estimates a shortfall of 61,000 drivers. In the fuel landscape, many fuel distributors have raised rates after years of steady pricing. In some instances, fuel carriers have had to double their freight rates or more to keep pace with rising driver and fuel costs.

The situation is not confined to the US. In the UK, companies are claiming to be “on the brink” of a crisis. There, they have a shortage of 65,000 drivers. With freight struggling around the world, it’s uncertain when the driver shortage will slow down and when normal activities can resume. For consumers, the best solution is to collaborate with fuel partners – simple tweaks such as expanding delivery windows and placing orders 48 hours in advance can help reduce the stress on the supply chain. Tight driver markets is an issue facing customers and suppliers alike, so partnering on a solution can help reduce the risk of operational failures.

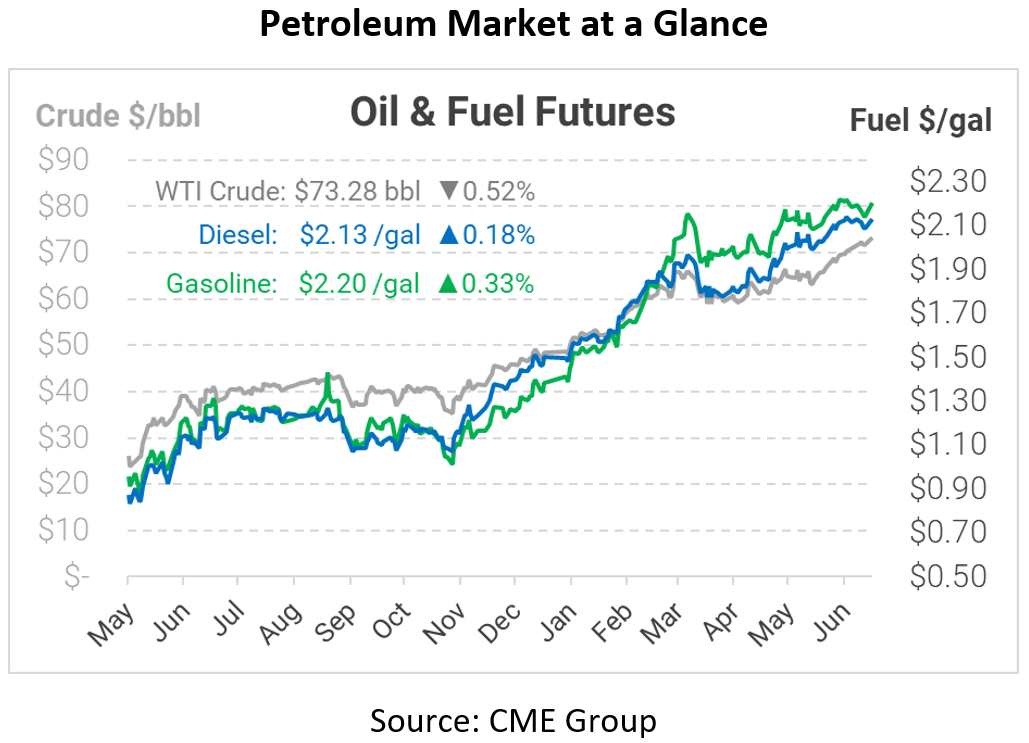

Why Fuel Prices Are More Expensive

Fuel prices have been featured a bit more prominently in the news; the problem is fundamentally a supply and demand issue. Over the next six months, demand is expected to rise by nearly 6 million barrels per day, bringing it back near pre-pandemic levels. As jet fuel demand normalizes and gasoline and diesel demand spike, analysts expect a strong downward trajectory for fuel and crude inventories.

Although there’s plenty of production capacity around the world to keep pace with demand, producers have been hesitant to ramp up output. OPEC+ has agreed to increase supplies by 2 MMbpd, but so far has not signaled whether further increases will come. American producers seem to be staying on the sidelines, focusing on cash flow rather than investing in new wells. Iran is a major wildcard for OPEC+ countries – if a nuclear accord is struck and the US lifts sanctions, Iran will increase their output by 2 MMbpd. This puts OPEC+ in a wait-and-see pattern – and causes uncertainty for oil markets. As long as OPEC+ is forced to wait on an Iran decision, they’ll keep restricting supplies, causing prices to keep rising.

Why DEF Prices Are More Expensive

Another rising expense is diesel exhaust fluid, which has seen prices increase steadily for the past several months. The primary commodity behind DEF is urea (and water, which is far more abundant). According to Green Markets, New Orleans (NOLA) urea prices have been on a tear, rising from a low of $300/ton in 2020 to nearly $700/ton today.

Urea prices are impacted by transportation demand, but the primary use of urea is producing fertilizer. With agricultural demand booming (since many crops are used both for food and industrial purposes), there’s been more need for fertilizer, causing its feedstock prices to rise. As a much smaller market, DEF rates are simply along for the ride.

In addition to rising DEF prices, packaging costs have also increased. The steel used for totes and the plastic resin used for jugs costs more than before, given the across-the-board increase in commodity prices.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.