Week In Review – May 28, 2021

Throughout the week, oil prices remained mostly flat, with a few jumps throughout the week. Crude jumped from $63.87 to $66.02 on Monday, and diesel also saw gains that day. Gasoline, however, remained consistently flat throughout the week with minor fluctuations.

Monday’s rise in fuel prices were ignited by the constant threats to the US-Iran nuclear deal. Iran finally reached agreement with the International Atomic Energy Agency (IAEA) on Monday. This deal showed that Iran was open to an agreement regarding their nuclear programs and arsenal. This deal possibly will not suppress prices for long and it is anticipated that oil prices could still climb to $80/bbl by the end of the year.

In other news, Tuesday showed oil nearing a one-week high as US drillers added oil and gas rigs. Oil rose more than 3% above last week’s numbers, crude futures were down 20 cents, and US West Texas Intermediate futures were off 29 cents after attaining near 4% gains on Monday. For the fourth week in a row, oil and natural gas rigs were added by United States energy firms due to higher oil prices. Last week, US oil rigs rose to 356, an increase of four rigs.

This Week in Energy Prices

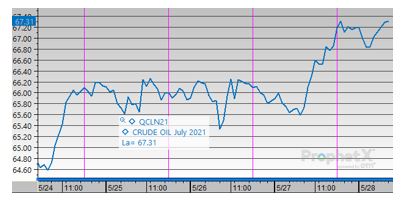

Today crude opened at a price of $66.95, an increase of $3.08 from Monday’s opening price of $63.87. Crude remained mostly unchanged other than the spike in price from Monday to Tuesday. Prices remained around the $66 mark throughout the week. Tuesday’s opening price of $66.02 was the highest in a one-week period. Thursday’s session brought another rally, sending prices to a 2.5-year high at closing time.

Today, diesel opening at $2.0650, an increase of $0.0725 from Monday’s opening price of $1.9925. Diesel prices jumped the highest from Monday to Tuesday, resulting in an increase of $0.0524. The rest of the week diesel remained mostly flat, excluding Thursday’s rally.

Today gasoline opened at a price of $2.1586, a decrease of $0.0866 from Monday’s opening price of $2.0720. Throughout the week gasoline prices were volatile, resulting in changes from day-to-day.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.