Colonial Aims to Open by End of Week

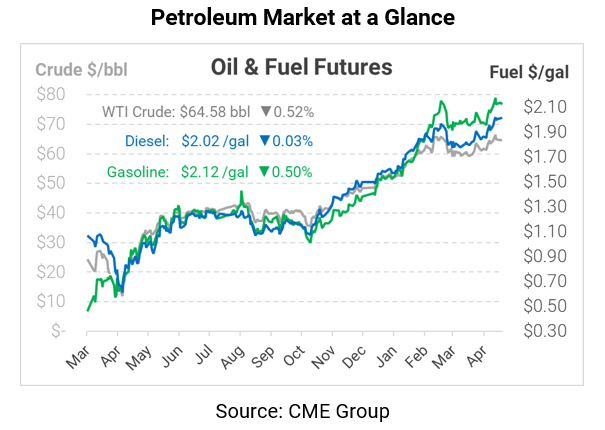

The Colonial Pipeline cyberattack has been a dominant headline in news reports this week, yet oil prices seem strangely calm. Although prices have certainly risen in the Southeast, where supply outages are beginning to pop up in gasoline markets, the impact on other markets has been minimal. After an initial panic that sent NYMEX gasoline and diesel prices almost 10 cents higher, trading returned to last week’s levels. The 5,500 pipeline remains offline, though in an announcement yesterday, Colonial advised they hope to be “substantially restoring” operations by the end of this week. For a complete rundown of the situation, check out the FUELSNews Detailed Report.

From a supply standpoint, some retail gas stations have already begun experiencing outages. Part of the problem is spiking demand – consumers are rushing to fill up their tanks out of fear there will be less supply later this week. Some gas stations in the Southeast have reported volumes rising 70% above average levels. The combination of spiking demand and limited supply has caused markets to burn through dwindling inventories.

The State of North Carolina has declared a state of emergency to loosen transportation restrictions and make it easier to haul fuel into the state. Georgia’s governor waived fuel taxes on Tuesday, seeking to mitigate the impact of higher prices on consumers.

The world doesn’t stop turning due to a US pipeline outage, and oil markets continued with their normal cadence of reporting. OPEC released their monthly oil report, which reiterated the cartel’s outlook of oil demand climbing 6 MMbpd before the end of 2021. They also lowered their estimate for non-OPEC oil supply by 0.2 MMbpd. Despite the bullish outlook, markets are struggling to look past the demand issues stemming from India.

This article is part of Daily Market News & Insights

Tagged: Colonial Pipeline, Cyberattack, diesel, gasoline, NYMEX, opec, supply outages, US pipeline outage

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.