One-Year Anniversary of Negative Oil Prices

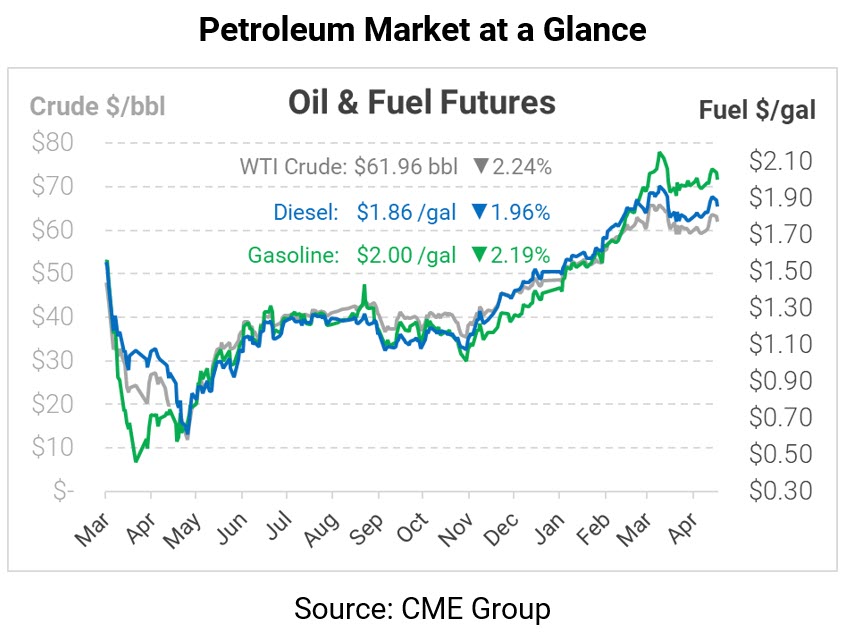

This morning, oil prices briefly turned higher following a force majeure situation in Libya, but since then markets have fallen into the red. Today marks one full year since WTI crude prices fell to -$37.63. Now, prices are back above pre-pandemic levels – and impressive feat, given the worst pandemic in a century.

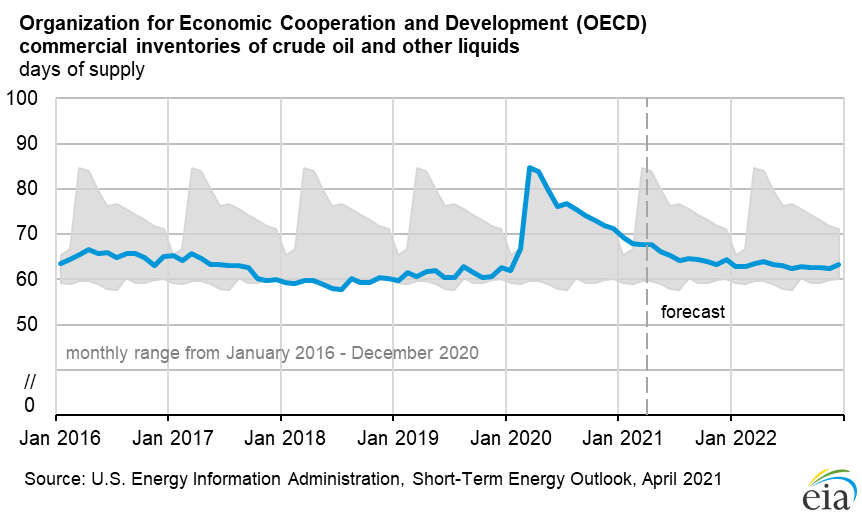

As oil prices remember negative prices last year, the look ahead is much rosier. Global oil cuts have nearly eliminated the inventory overhang caused by the pandemic. Global crude days of supply, which rocketed above 80 days during the pandemic, is back in line with the pre-COVID five-year range. Although inventories sank low in 2018, current levels are quite close to 2016-2017 levels. Moreover, inventories are expected to continue falling. Although OPEC+ has plenty of spare capacity to flood markets if they choose, the outlook suggests that inventories will continue falling throughout the year.

Libya was forced to declare force majeure at its Hariga port, citing budgetary disputes. The port exports 180 kbpd to international markets, so the shutdown will temporarily reduce global fuel supplies. Instability in Libya has repeatedly caused issues for global oil markets – at various points, militant threats and force majeure situations have caused up to 1 MMbpd of Libyan oil to fall off the market. While the latest news seems short-term and limited in scope, reports from Libya tend to scare the market and result in rising prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.