Interest Rates Hold, EIA Shows Surprise Builds

Yesterday ended with marginal losses for oil prices, but this morning prices are tumbling lower as the market considers the Fed’s latest interest rate policy and a bearish EIA report. The 4-day streak of losses, soon to be 5 days, marks the longest downtrend in six months. Crude prices are down $3.80 from last week’s peak, and diesel and gasoline are down 12 cents and 14 cents, respectively. Delayed vaccines rollouts in Europe are also contributing to bearish sentiment.

The Federal Reserve held interest rates at the current 0%-0.25% range, in line with expectations. Fed Chairman Jerome Powell has repeatedly taken a dovish stance to interest rates, arguing that any inflation concerns will be short-lived. Although some groups, such as Goldman Sachs, expect rate hikes in the next few months, the current Fed consensus is no interst rate hikes until 2023 or beyond. Low interest rates make American investments (and US dollars) less appealing, causing the dollar to drop. A weak dollar is bullish for oil prices

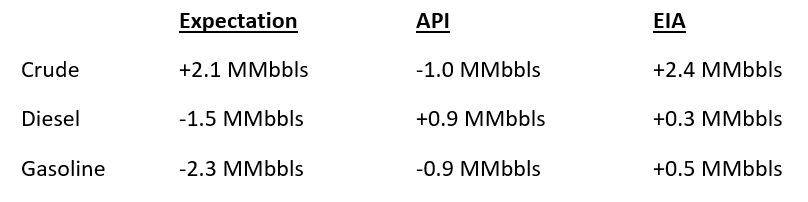

The EIA released their weekly oil report, which showed a surprise across-the-board build for crude and refined products. Markets had expected a moderate crude build, but diesel and gasoline builds were considered unlikely given on-going refinery outages. On that topic, refinery utilization climbed to 76% – a bigger uptick than expected, though still far from seasonal averages around 85-90%. Gulf Coast utilization rose to 70.7%, up from 60.7% last week.

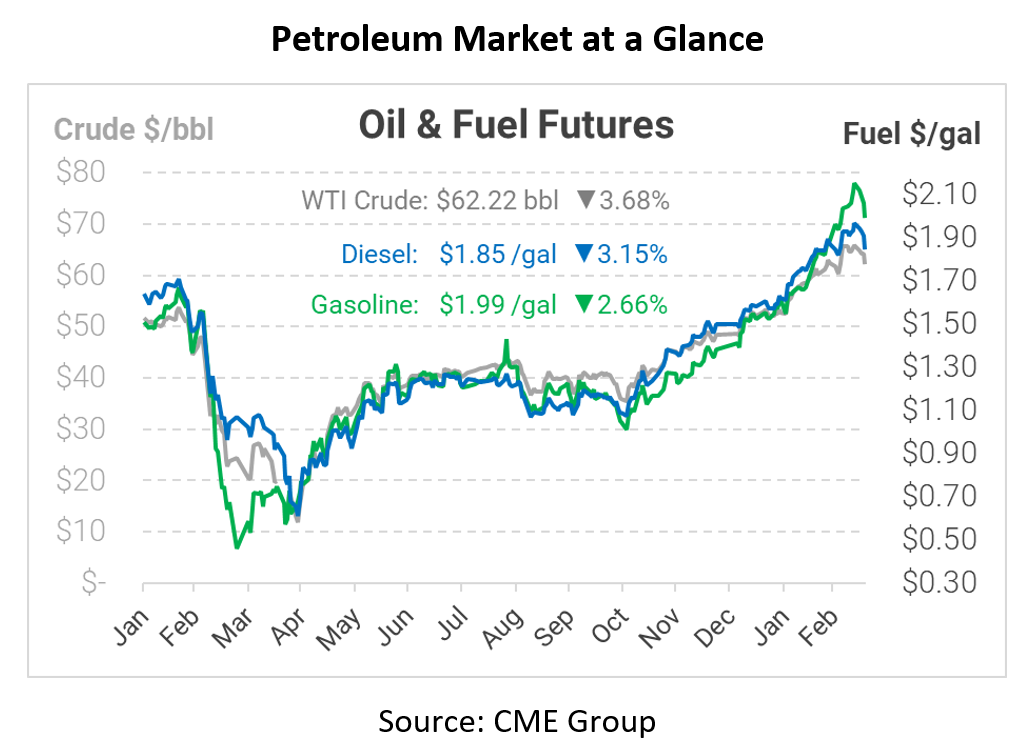

This morning, oil markets are tumbling. Crude oil is trading at $62.22, down $2.38 (-3.7%) from Wednesday’s closing price.

Fuel prices are also seeing a strong selloff today. Diesel is trading at $1.8450, down 6 cents (-3.2%) from yesterday’s close. Gasoline is trading at $1.926, down 5.5 cents (2.7%).

This article is part of Daily Market News & Insights

Tagged: Inflation, interest rates, Inventories

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.