Oil Falls on EU Vaccine Hiccups, Bearish IEA Report

Yesterday brought more jagged trading, with oil prices falling in the morning before cutting losses later in the day. Net losses yesterday were 60 cents, roughly a 1% drop. Markets are reacting strongly to investigations in Europe into the Oxford/AstraZeneca vaccine. Around 40 patients experienced blood clots (out of 17 million), leading several European countries to halt the vaccine rollout until it can be investigated. AstraZeneca stated the incidence rate is below population averages, but at least ten countries have paused distribution until the EU’s medical regulator issues new guidance. The hiccup could delay the EU’s goal of having 70% of their population vaccinated before September, in turn impacting fuel demand as countries maintain their lockdowns for longer.

The API released their inventory report, which showed a surprise crude draw. Given on-going challenges in Texas, markets are closely watching every data point for when supplies will improve. The API’s report suggests that trends are getting closer to normal, with demand for crude rising. Traders will be watching the EIA’s weekly report very closely today, particuarly the refinery utilization data. Two weeks ago, the EIA revealed a record-low utilization rate of 56%; last week, that rose to 69%. Markets are hoping for higher utilization this week, which would suggest refiners are finally getting back to normal throughput.

The IEA released their March Oil Market Report today, refuting claims of an oil market supercycle. The agency notes an abundance of inventories, including 110 million barrels of excess crude stocks in developed countries. The group also projects that world oil demand will not hit pre-COVID levels of 100 MMbpd until 2023. By contrast, the US EIA is forecasting oil demand surpassing 101 MMbpd in 2022.

The key difference between the IEA and other forecasters is their outlook on OPEC+ actions. The IEA argues that spare capacity among OPEC member countries provides a buffer for oil prices. Conversely, banks and analysts point to OPEC’s recent decision to maintain current cuts as evidence they will not react to tightening supply and rising prices. It’s a basic “will they or won’t they” debate, but ultimately we won’t know who’s correct unless OPEC+ provides more guidance on their future strategy.

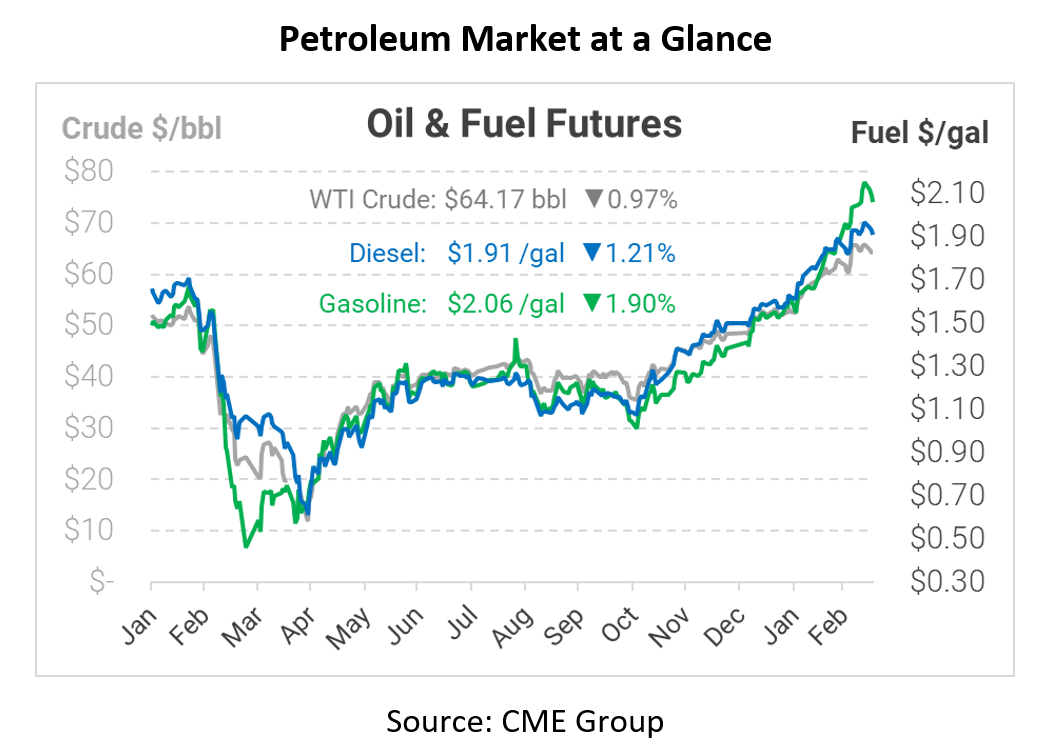

Crude oil prices are falling lower once again this morning, extending the streak of losses. WTI crude is currently trading at $64.17, down 63 cents (-1%).

Fuel prices are also sinking today, outpacing crude’s losses. Diesel is trading at $1.9094, down 2.3 cents per gallon (-1.2%). Gasoline prices are currently $2.0613, shedding 4 cents (-1.9%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.