Three Banks Call for $70/BBL Oil

Although the market is down this morning, there’s a general bullish sentiment surrounding the market. First and foremost, new COVID cases are plummeting thanks to careful health practices and vaccine distribution. Daily new cases are now less than a quarter of their January peak, and daily deaths are beginning to fall as well. The same trend is true at a global scale, though at a slower pace. Trumpeting the bullish feelings, three US banks – Goldman Sachs, Morgan Stanley, and Bank of America – each forecast that Brent Crude would rise above $70/bbl in Q2-Q3. Goldman even believes oil could rise as high as $75/bbl in Q3.

Oil prices are falling lightly this morning after climbing to new highs on Monday. Although the Texas market is recovering slowly, oil producers and refiners have been slow to bring production back online. Operational challenges and technical malfunctions all play a role in hindering restarts, so there’s a long process of starting, testing, stopping, and restarting.

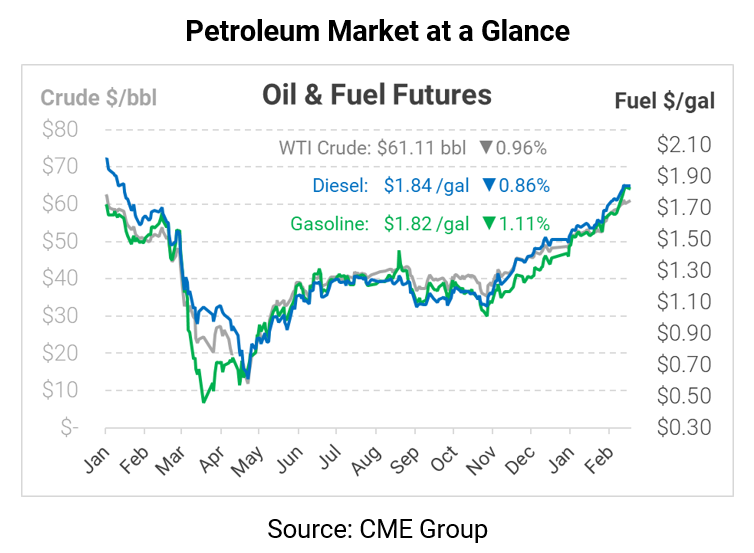

Crude oil is trading lower this morning after big gains on Tuesday. WTI crude is trading at $61.11, down 59 cents (about 1%) from Monday’s closing price. Brent crude oil is trading about $3.75 above WTI crude.

Fuel prices are also moving lower this morning. Diesel is trading at $1.8426, down 1.6 cents (0.9%) from yesterday’s closing price. Gasoline is trading at $1.8213, 2 cents (1.1%) down.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.