New Single-Shot Vaccine Shows 72% Efficacy in US

Oil markets are rising higher this morning, supported by a new Johnson & Johnson vaccine reaching the end of clinical trials. Although the efficacy appears to be just 72% in the US (and lower against the South Africa variant), it only requires a single jab, making its logistics far less complex than the Pfizer and Moderna vaccines. The low efficacy is relative – most flu vaccines are just 40%-60% effective, so a 72% rate is medically quite high. More vaccine means a faster recover, and gasoline prices are soaring.

Oil majors are publishing their Q4 earnings reports over the next week, beginning today with Chevron. While Chevron’s earnings fell short of analyst expectations, the market will be watching over the next week as other majors share their financial and operational notes from the prior quarter. Many oil majors announced multi-billion dollar write-downs in Q4, weighing heavily on their finances. Watching the financial performance of the industry’s largest participants provides clues on the future of oil markets. They set the tone for industry profitability, future production investments, and the transition to renewable fuels.

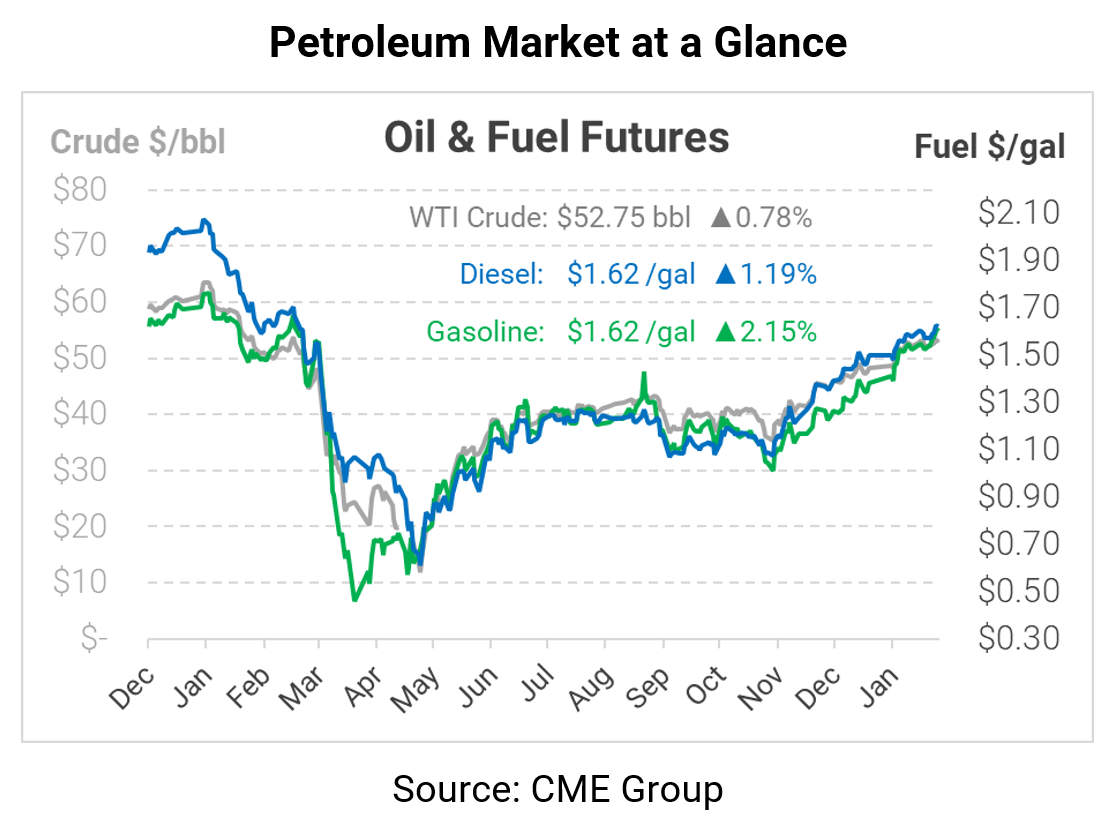

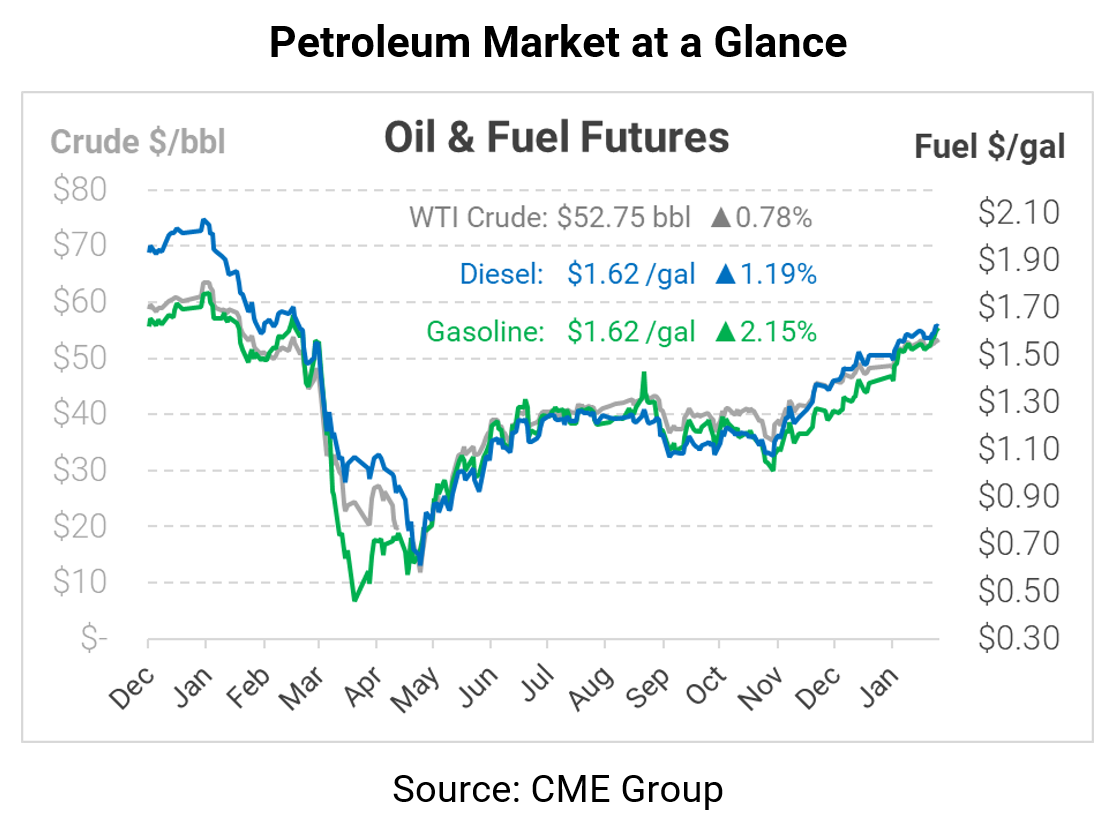

This morning, the oil complex is heading higher, with gasoline leading the way. WTI crude is trade at $52.75, a gain of 41 cents per barrel.

Rising fuel prices are supporting 3:2:1 crack spreads, which are now over $15/bbl for the first time since April 2020. Gasoline is leading the way – as vaccines continue being distributors, consumers will feel safer travelling and returning to work. Gasoline prices are trading at $1.6170 this morning, up 3.4 cents (2.2%). Diesel is currently $1.6207, up 1.9 cents (1.2%) from Thursday’s closing price.

This article is part of Daily Market News & Insights

Tagged: COVID-19, Oil Majors, vaccines

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.