Week in Review – January 8, 2021

It’s certainly been a crazy week, filled with headlines with direct implications for oil fundamentals. This week brought a major oil production announcement, a political shift in the US Senate, and violent protests at the US Capitol. Let’s break down some of the top headlines this week and the impact on oil

1. Saudis Announce Unilateral Cuts – Saudi Arabia elected to cut production by 1 MMbpd, a decision stemming straight from Crown Prince Mohammad bin Salman. Saudi Arabia is deeply committed to the endurance of OPEC+ cuts, taking a financial hit so that Russia and Kazakhstan could raise output slightly without spooking markets.

2. Democrats Take Control of US Senate – With the runoff election in Georgia complete, Democrats have won control of the Senate, giving them both house of Congress and the White House. It’s no secret that the left tends not to be pro-oil, and President-Elect Biden has called for an immediate fracking permit ban on federal land. With US producers already suffering from high debt and poor credit, tighter regulations will push the already unlikely shale recovery even further out. On the flip side, friendlier policies towards Iran and legislation increasing engine efficiency could both keep fuel prices lower overall.

3. Protests in the US Capital – This week brought major protests in the US Capitol, with demonstrators breaking windows and roaming the halls of the Capitol building. Although the event does not directly impact oil prices, it shows a level of political uncertainty not seen in a century in the world’s oldest continuous democracy. Markets hate uncertainty, but given America’s status as both a major producer and a giant consumer, it’s hard to know how instability might impact prices.

4. EIA Crude Draw – Amidst alarming global headlines, the EIA’s report of an 8 million barrel crude draw seems to have slipped through the cracks. But, considered with the combined 10 million barrel build for diesel and gasoline, it shows fragile markets that still are not absorbing enough fuel. Holiday demand was weak, but refiners kept processing anyways. Even with giant fuel product builds, 3:2:1 crack spreads grew this week to $12/bbl, the highest since August.

The year 2021 is only a few days old, and already it’s seen months worth of activity and drama. Strap in – the next few months could be a bumpy ride.

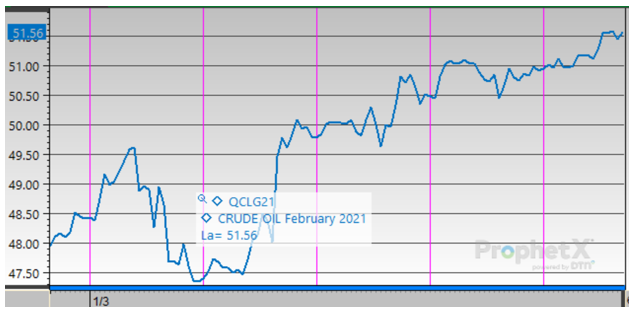

Prices in Review

Crude prices got off to a slow start on Monday, with prices dropping down to $47.50 after opening at $48.40. They climbed on Tuesday though thanks to support from Saudi Arabia, and that announcement has continued providing tailwinds to fuel prices for the week. This morning, WTI crude opened at $50.93, a gain of $2.53 (+5.2%).

Diesel prices had a similar run, dropping on Tuesday before climbing for the remainder of the week. Diesel opened the week at $1.4598 and by Friday’s opening price had climbed to $1.5405, a gain of 8.1 cents (5.5%).

Gasoline saw even more exuberant gains this week, with markets hopeful for the consumer-driven product to continue improving. Opening on Monday at $1.3660, gasoline climbed to open this morning at $1.4866, a notable gain of 12 cents (+8.8%).

This article is part of Daily Market News & Insights

Tagged: crude, Democrats, diesel, Fracking, gasoline, President-Elect Biden, Protests, US Capital, US Senate

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.