Natural Gas News – January 4, 2021

Natural Gas News – January 4, 2021

PetroChina Looks To Double Shale Gas Output By 2025

State energy giant PetroChina plans to increase the natural gas output from its shale operations in the Sichuan province twofold to over 22 billion cubic meters in the next five years, Reuters reported, citing state Chinese media. China has been looking to boost domestic natural gas production in the face of rising demand and with it, rising dependence on imports. Most recently, Beijing eased restrictions on foreign companies to invest in the country’s gas industry and offered subsidies for natural gas developments. The incentives include extending the period for exploration for the companies to five from three years, and allowing foreign oil and gas firms to directly operate in the country as long as they have an office registered in China. China has abundant shale gas reserves, but the geology is tricky, making the development of these reserves challenging. For more on this story visit oilprice.com or click https://bit.ly/2Xm15qd.

Viewpoint: US midcon gas prices may get weather boost

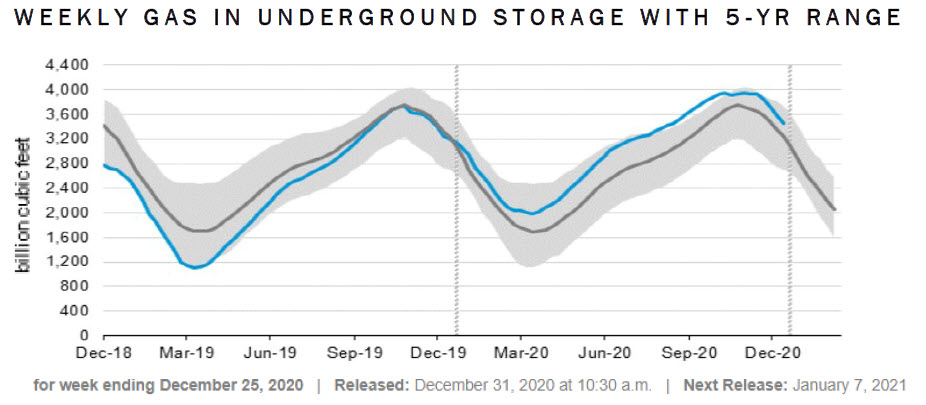

Even with midcontinent heating needs being mostly below year-earlier levels so far this year, expectations for colder weather as the winter unfolds

have kept regional gas prices above $2/mmBtu amid replete regional storage levels and the closure of non-essential businesses because of Covid-19. This winter was forecast to be about 4pc colder than a year earlier and 1pc colder than the 10-year average, according to the National Oceanic and Atmospheric Administration. But recent midcontinent temperatures have actually stayed above the seasonal average, reminding many market participants of last winter’s warmth. For more on this story visit argusmedia.com or https://bit.ly/2KZq9k6.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.