Longer Recovery Ahead, but Prices Still Buoyant

Oil prices are trading flat this morning after hitting yet another 9-month high, showing that the near-term pessimism cannot overcome long-term hope. The FDA’s emergency authorization for the Pfizer vaccine contributed to the market exuberance.

This week, the EIA raised its Q1 2021 Brent forecast by $5/bbl to $47/bbl, though this average is still lower than the current price environment. The discrepancy suggests the EIA does not expect vaccine news to continue pushing prices higher; rather, prices will remain at or near current levels until countries whittle down persistently high crude inventories.

The EIA’s Short-Term Energy Outlook also pushed back the timeline for crude returning to its 5-year range. Previous forecasts showed OECD crude stocks falling into the five-year range early in the year and moving closer to the middle of the range by late 2021. Now, inventories will not reach the 5-year range until June 2021, trending at the high end for the remainder of the year.

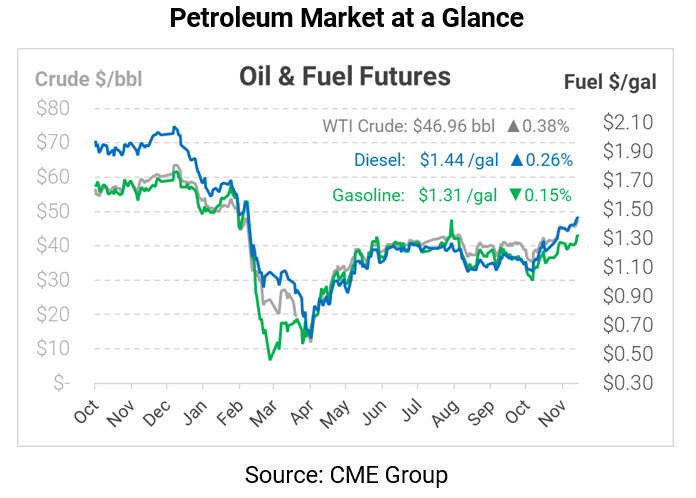

Crude oil prices are fluctuating between small gains and losses this morning, though the trend is currently a bit higher. WTI crude is trading at $46.96, a gain of 18 cents.

Fuel prices are also trading mixed this morning. Diesel also set a 9-month high yesterday, and early trading today is pushing prices even higher. Diesel is trading at $1.4395, up 0.4 cents. Gasoline prices rallied heavily in August, so the current rally represents just 4-month highs. Gasoline is trading at $1.3146, down 0.2 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.