Builds in Crude and Products Pressure Markets

On Tuesday, WTI crude closed lower on pessimistic news of a delayed meeting by OPEC+ regarding continuation of current supply cuts into next year. Crude is trading sideways this morning, but is feeling downward pressure from bearish inventory news from the API.

Yesterday, the API reported a surprise build in crude and stock increases in distillates and gasoline. The gains in fuel inventories are seasonally normal – this time of year, fuel demand falls and refiners are typically refilling inventories to get ahead of spring demand. Given the pandemic and where inventories have been this year, though, markets are jittery of any uptick in stocks.

Increasing stocks fan the flames of demand recovery fears amid rising coronavirus infections. While news of effective vaccines have sparked a recent rally in oil, the widespread distribution of the vaccines to the general populace is still many months away. Traders weigh the current rate of infections versus the hope of future rising demand due to vaccines.

The bearish inventory news comes in as OPEC+ is deliberating on continuation of current supply cuts of 7.7 MMbpd into next year. The UAE has voiced some dissatisfaction with rolling over current supply cuts into January. The Saudi’s have argued that current supply and demand dynamics may require supply cut extensions to keep the market balanced. OPEC+ will meet tomorrow as traders wait expectantly on the group to take action.

The API’s data last night:

The API reported a large surprise build for crude of 4.2 MMbbls versus an expected draw of 2.4 MMbbls. At Cushing, they had a build of 0.1 MMbbls. The API reported that distillates had a small increase in stocks. Gasoline inventories had an increase. The EIA will report numbers later this morning.

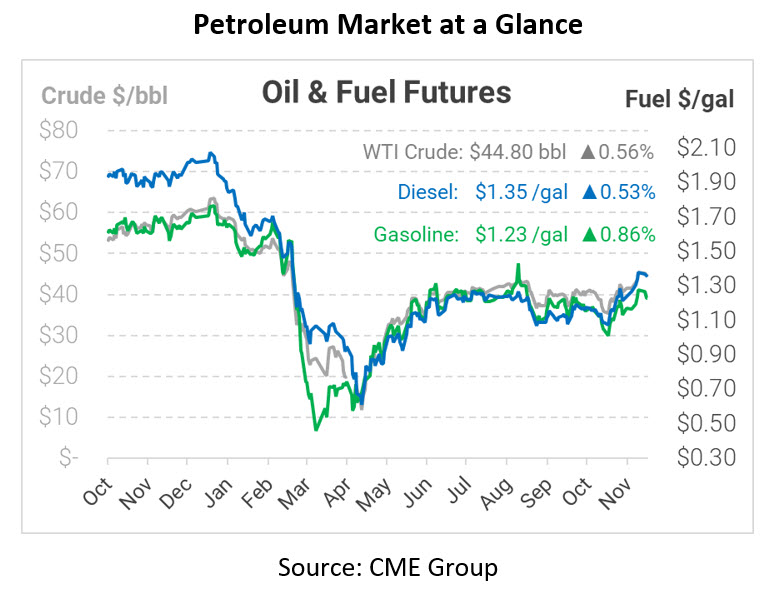

Crude prices are up this morning. WTI Crude is trading at $44.80, a gain of 25 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.3545, a gain of 0.7 cents. Gasoline is trading at $1.2309, an increase of 1.1 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.