OPEC+ Meeting Delayed Due to Disagreements

Crude closed down slightly yesterday. It is continuing to lose ground in early trading this morning. Pessimistic news coming out of the OPEC+ meeting is putting downward pressure on the market.

The OPEC+ meeting scheduled for today has been pushed back to Thursday due to disagreements among members regarding continuing supply cuts next month. OPEC+ had initially planned to bring back 2.0 MMbpd of production starting in January. Some members are not happy with continued supply cuts. Saudi-Arabia offered to step down as OPEC+ JMMC co-chair to appease the UAE, who have felt out of the loop during Saudi-Russia negotiations. The move is meant to help members come to an agreement to continue current supply cuts into next year.

OPEC is considering several factors. The return of Libyan barrels to the international market and the return of production from the US Gulf Coast after a busy hurricane season have put pressure on OPEC+ to balance the market in the face of increasing supply. In addition, rumors had been swirling last month of the UAE considering leaving OPEC. As the third largest crude producer in OPEC, the UAE has a lot of influence. If they should leave, many believe others will follow.

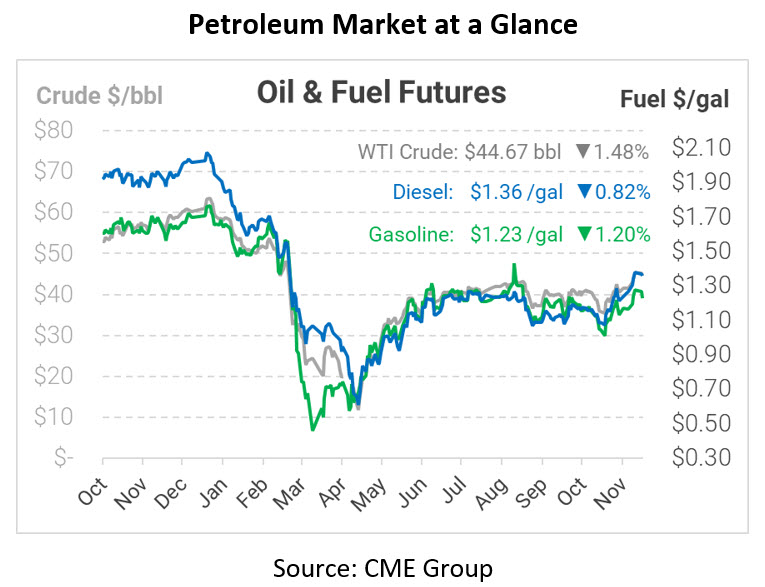

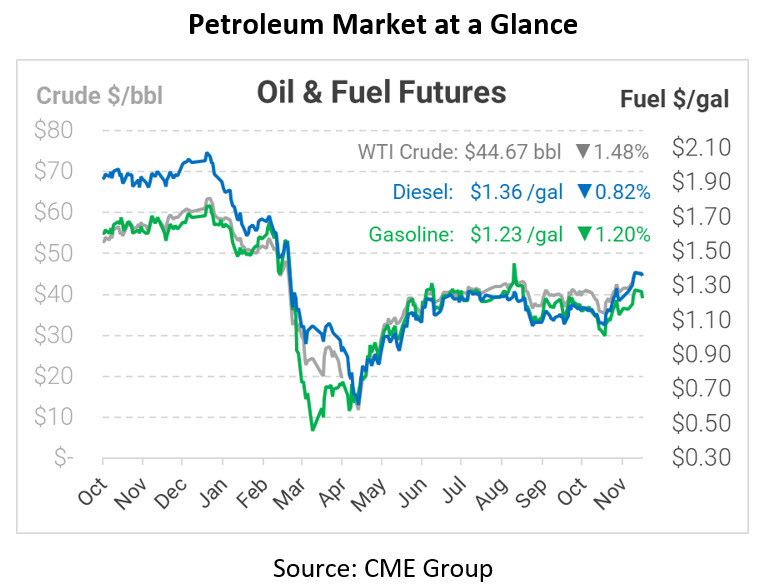

In early trading today, crude prices are down. Crude is currently trading at $44.67, a loss of 67 cents.

Fuel prices are down this morning. Diesel is trading at $1.3602, a loss of 1.1 cents. Gasoline is trading at $1.2267, a loss of 1.5 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.