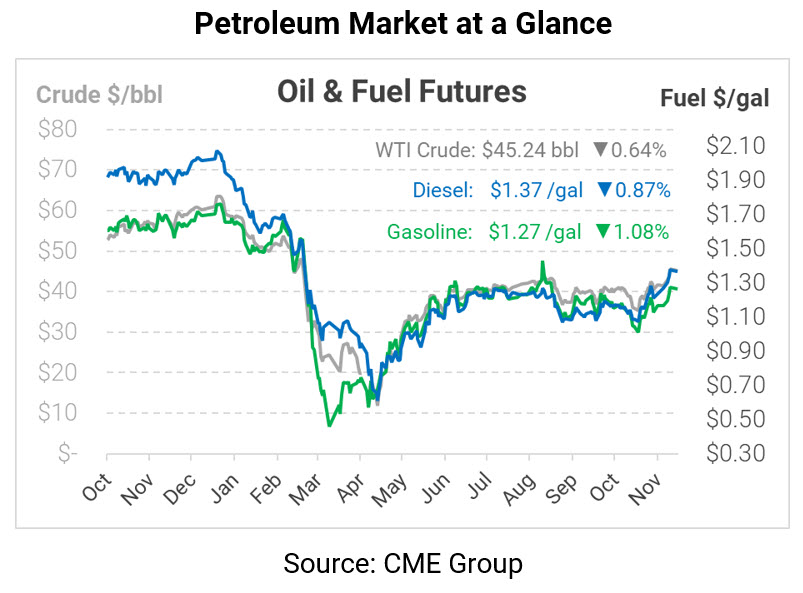

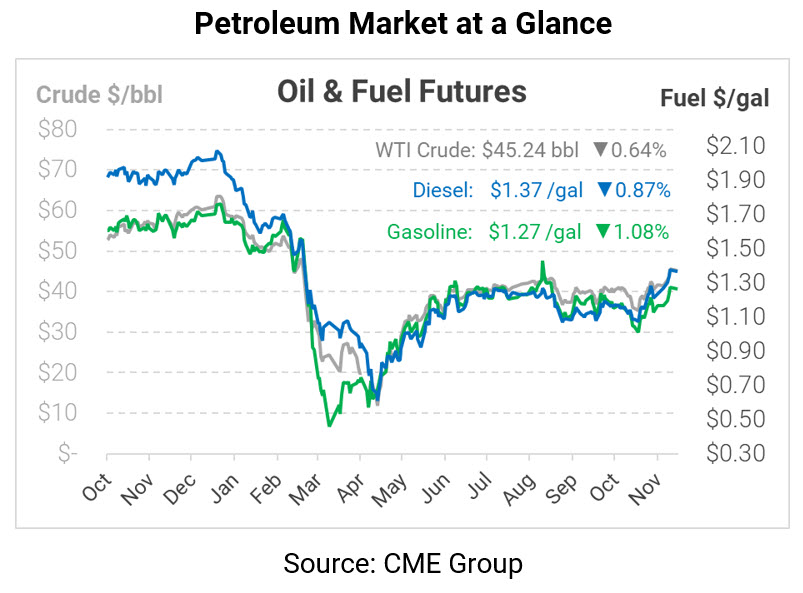

Market Structure Suggests Rising Prices in 2021

After a long holiday weekend with little activity during Friday’s trading session, crude oil markets remain near the highs set last Wednesday, thanks to anticipation of a COVID vaccine and OPEC production cuts. The OPEC+ gang is meeting today to discuss the future of cuts. The group is cutting output by 7.7 MMbpd today, scheduled to lighten to just 5.8 MMbpd in January.

Market consensus suggests the group will extend 7.7 MMbpd cuts through Q1 2021, effectively keeping 1.9 MMbpd (170 MMbbls total in Q1) off the market. If OPEC+ chooses to continue with its current loosening, prices could fall this week. Conversely, if OPEC+ announces even deeper cuts, prices might rise even higher. With the future outlook improving, some market indicators are now beginning to show bullish signs ahead.

Last week, the WTI Crude forward curves – the price of crude oil delivered in future months – changed from a contango structure to backwardation in 2021 (visual representation below). Contango simply means that future prices are higher than today, while backwardation means future prices are expected to be lower than today.

A backwardated market might seem bearish at first; after all, the market is seemingly predicting lower prices in the future. In reality, it’s actually a bullish indicator for three reasons:

- Backwardation tells suppliers that the market is tight on supply now, so they should pull from inventories to avoid losing money as prices fall in the future. This signal causes inventories to fall, pushing prices even higher.

- It tells oil producers, who usually cannot quickly react to market changes, that future prices will be lower, so they should prioritize short-term gains instead of investing in long-term production.

- Backwardation benefits traders, who can buy, for example, 1,000 barrels of oil in June, then roll to July’s lower price to buy 1,005 barrels with the same amount of money. As traders keep piling in, they stimulate artificial demand, lifting the overall price even if fundamentals remain the same.

It’s worth noting that markets are not fully backwardated. Between now and early 2021, WTI crude prices are still in a contango (read: bearish) structure. Once demand picks up and a vaccine is deployed, though, the expectation is backwardation – and ultimately higher prices. This is beginning to show up in analyst forecasts. Goldman Sachs recently lifted their 2021 Brent price forecast to $65/bbl.

For fuel buyers whose budgets are adversely affected by rising fuel prices, now could be an optimal time to consider risk management solutions like price caps or fixed price to manage price risk. Gambling that fuel prices will remain at historic lows is a risky bet. Fleets that do not lock in their fuel price for 2021 cannot be certain they will meet or beat their fuel budget. There’s no time like the present to analyze price risk, evaluate fuel volumes, and consider locking in some or all of your 2021 budget.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.