Europe Fears Second Recession as Infections Rise

Last week, WTI Crude finished sharply lower on multiple triggers including bearish inventory news and the return of Libyan supply to the market. The market is continuing its losses in early trading this morning ahead of tomorrow’s election. Uncertainty around the election and fears of a second recession due to the second wave of coronavirus lockdowns in Europe and North America are putting downward pressure on markets.

France, Germany, the United Kingdom, and Belgium are all going back into nationwide lockdowns – shutting all restaurants and non-essential businesses for several week and also restricting travel. The new round of restrictions is weighing on sentiment around the pace of economic recovery in Europe. While Europe enjoyed robust GDP growth in the third quarter, they are still down 4% compared to this time last year. The decline in economic activity expected with a second wave of lockdowns has people fearful of a second recession setting in as the year ends. There is concern that the lockdowns will interfere with holiday spending and travel and push Europe into a recession.

In the US, surging coronavirus cases have people thinking about a second wave of restrictions. On Friday, daily coronavirus cases in the US set a record at 99,321 cases. The US death toll from Covid-19 now stands at more than 230,995, the highest number of fatalities worldwide.

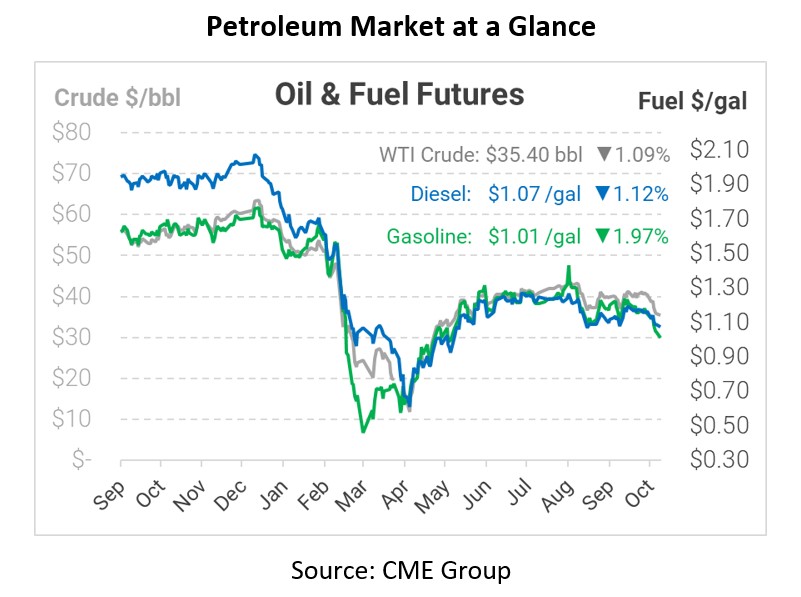

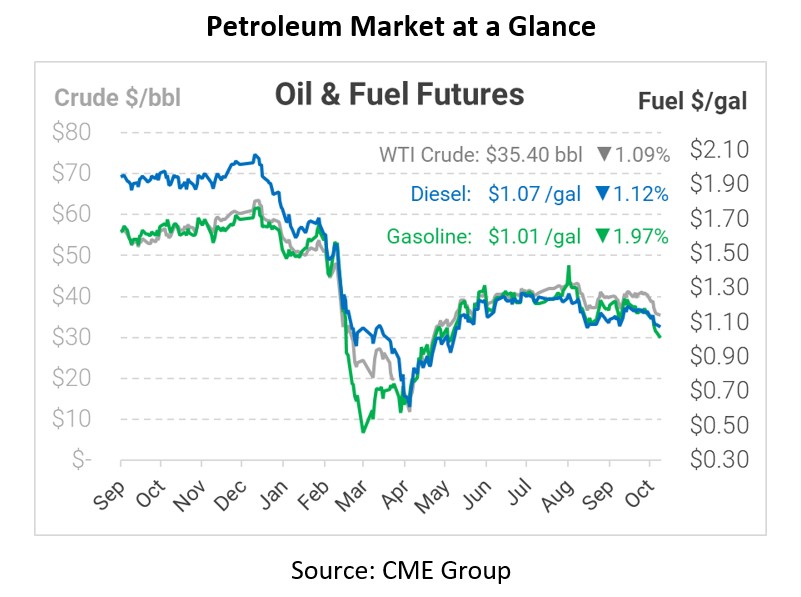

In early trading today, crude prices are down. Crude is currently trading at $35.40, a loss of 39 cents.

Fuel prices are down this morning. Diesel is trading at $1.0737, a loss of 1.2 cents. Gasoline is trading at $1.0119, a loss of 2.0 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, Europe, lockdowns, recession

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.