Bearish Triggers Drive Market Lower

On Tuesday, WTI crude rose on the news of Hurricane Zeta making its way through the Gulf and shutting in production. This morning, however, the market is dropping sharply on bearish inventory news from the API late yesterday.

A number of bearish triggers are driving the market lower this morning:

- The fear of slowing demand recovery due to rising coronavirus cases around the world is a primary driver moving markets lower.

- A larger-than-expected build in crude and a surprise build in gasoline is offsetting any effects of a large draw in diesel.

- The diminishing hope of an economic stimulus package in the US before the election is also pushing markets lower. While everyone agrees more stimulus is needed, how much to spend is still under debate.

- The very real prospect of a contested US election is causing tension in the markets. Trump is insisting on calling a winner on election night, but with so many absentee ballots to be counted, that may not be possible.

- Finally, on the supply side, the return of up to 1 MMbpd of Libyan crude is putting downward pressure on markets.

All these factors are coming together to drive the markets lower with little to no bullish news to counteract them. The one positive note is the continued reassurance by OPEC that they will support a balanced market. Only time will tell if this will be enough momentum to sway prices.

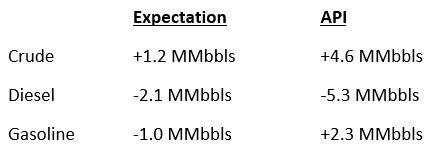

The API’s data last night:

The API reported a build for crude of 4.6 MMbbls versus an expected build of 1.2 MMbbls. At Cushing, stocks increased by 0.1 MMbbls. The API reported that distillates had a large decrease in stocks. Gasoline inventories had an surprise increase. The EIA will report numbers later this morning.

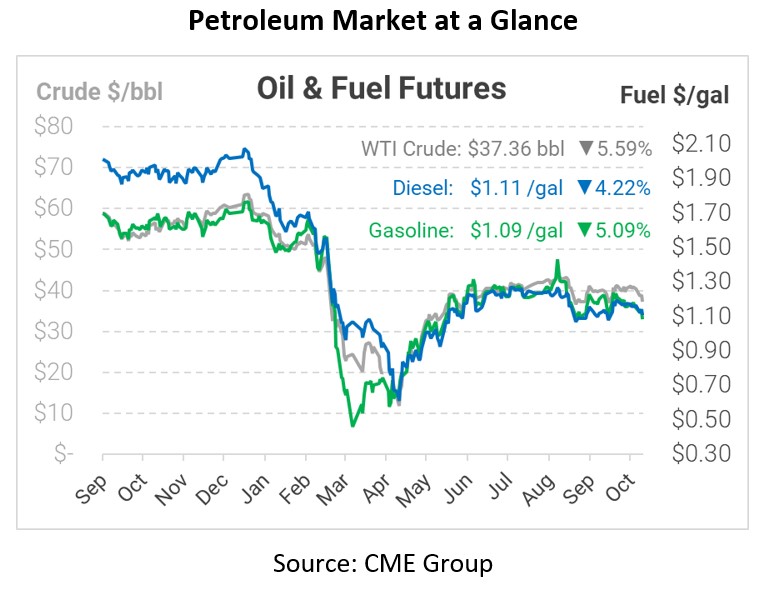

Crude prices are down this morning. WTI Crude is trading at $37.36, a loss of $2.21.

Fuel is down in early trading this morning. Diesel is trading at $1.1089, a loss of 4.9 cents. Gasoline is trading at $1.0852, a decrease of 5.8 cents.

This article is part of Daily Market News & Insights

Tagged: API, coronavirus, election, inventory, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.