Fear of Rising Supply Pressures Market

On Tuesday, WTI crude closed up following US equities higher on the hope of a stimulus package making progress before the election. While chances of passing a stimulus package before November are slim, the markets are closely following news about progress.

Crude is down in early trading this morning. A surprise build in US inventories as reported by the API has the market fearing the possibility of a global supply glut. The return of Libyan supply to the market and the planned easing of supply cuts by OPEC in January is raising anxiety about an oversupplied market. On the demand side, a second wave of coronavirus infections in the US and Europe is causing concern of a faltering demand recovery. All eyes are on OPEC for a signal of how they will proceed given the existing circumstances.

The API’s data last night:

The API reported a surprise build for crude of 0.6 MMbbls versus an expected draw of 1.0 MMbbls. At Cushing, stocks increased by 1.2 MMbbls. The API reported that distillates had a large decrease in stocks – this large draw is surprisingly having minimal effects on the market as traders seem to be waiting on EIA numbers. Gasoline inventories also had a decrease. The EIA will report numbers later this morning.

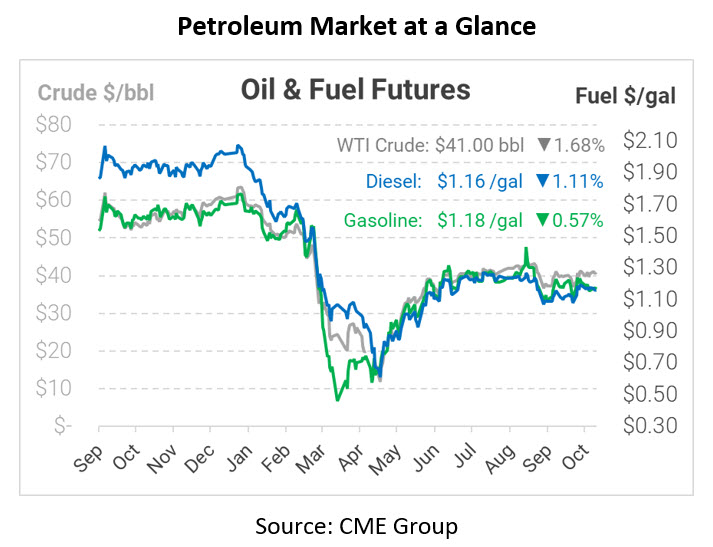

Crude prices are down this morning. WTI Crude is trading at $41.00, a loss of 70 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.1605, a loss of 1.3 cents. Gasoline is trading at $1.1811, a decrease of 0.7 cents.

This article is part of Daily Market News & Insights

Tagged: API, coronavirus, Glut, opec, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.