Are American Oil’s Best Days Behind It?

After moderate gains early this morning, the oil complex is trading sideways to open the new week. Most indicators from the weekend suggest higher prices for the week. The US Dollar is creating tailwinds for oil; after rising to the highest level since July last week, USD losses this morning are propping up commodity markets. Adding support, most market participants now expect oil markets to return to balance relatively soon. This sentiment was echoed by OPEC’s Secretary General Mohammad Barkindo over the weekend, who noted that OECD stocks should return to the 5-year average around Q1 2021.

Last week, the Dallas Federal Reserve published its quarterly survey of energy companies, which showed mixed optimism and pessimism for the future of US oil. The report asked oil and gas explorers and producers about their outlook for the future. Most oil and gas E&Ps (44%) expect oil to end the year in the $40-45 range, with an additional 44% expecting prices to end the year even higher than that. With oil fundamentals rebalancing, the outlook for WTI crude seems to be improving significantly. On the other hand, rising prices won’t be enough to revive the suffering shale industry. Two-thirds of those surveyed believed that US oil production peaked in early 2020 at 13 MMbpd – meaning America’s most productive years may be in the past.

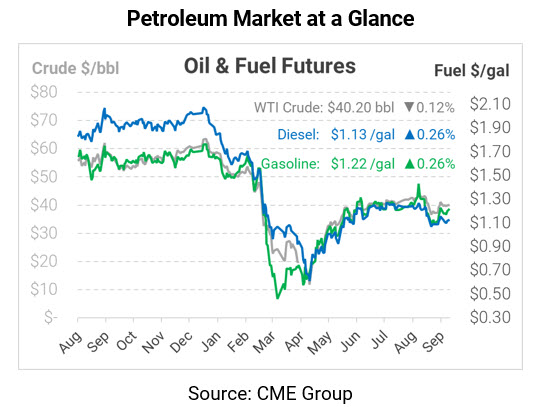

Crude prices settled above $40/bbl on both Thursday and Friday last week, and despite lower training at some points, prices remain above that threshold this morning. WTI crude is trading at $40.20 this morning, just five cents off from Friday’s closing price.

Fuel prices are showing very modest gains this morning, supported by continued demand recovery in the US and abroad. Diesel prices are currently $1.1291, up 0.3 cents since Friday. Gasoline is trading at $1.2174, also up 0.3 cents. Gasoline trading nearly 10 cents above diesel is somewhat a seasonal anomaly – heading into fall, gasoline prices usually sink lower, and diesel reigns supreme. But with diesel inventories still exceedingly high and gasoline inventories moving back to normal levels, markets are telling refiners to limit diesel outputs and prioritize gasoline now.

This article is part of Daily Market News & Insights

Tagged: Dallas Energy Survey, gasoline, Inventories, Oil production, opec, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.