Week in Review – September 18, 2020

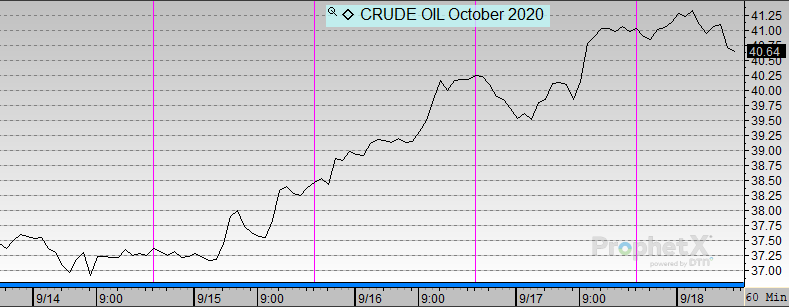

Blink and you might have missed the faltering oil market from past weeks. WTI crude broke below $40/bbl on September 4, and by the middle of this week had already gained a position above that threshold. The week started with bearish news including the UAE uncharacteristically pumping above their OPEC quota. In addition, Libya announced plans to add 1MMbpd to global supply after months of conflict.

Hurricane Sally caused supply disruptions which helped markets rise. Nearly 500 kbpd of crude was taken off the market for five days while the storm hit the US. This will affect next week’s inventory numbers, but the return of production from oil platforms in the Gulf will be bearish for prices.

This week the EIA reported that crude fell to its lowest level since April. A surprise crude draw reported mid-week helped prices rise to close out the week. US crude oil inventories are about 14% above the five-year average for this time of year.

OPEC chatter regarding member country compliance and strong reaffirmation of goals helped to support the market as the week ended. Saudi Arabia gave non-compliant countries until December to make up for over-production beyond OPEC quotas. Saudi Arabia also strongly stated that traders should not bet against OPEC and its plans to balance the markets.

Prices in Review

WTI Crude opened the week at $37.32. It opened flat then tracked steadily upward throughout the week. Crude opened Friday at $40.97, an increase of $3.65 (9.8%).

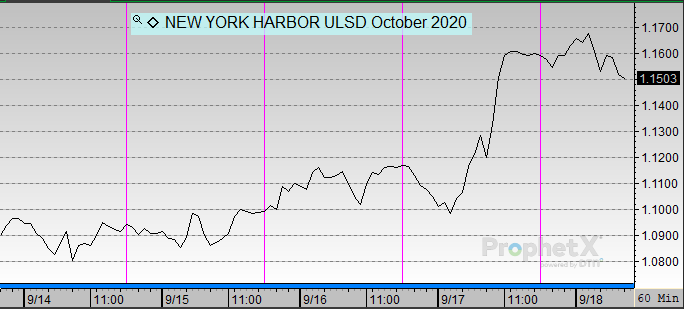

Diesel opened the week at $1.0937. It was relatively flat until after mid-week when it spiked higher. Diesel opened Friday at $1.1610 a gain of 6.7 cents (6.2%).

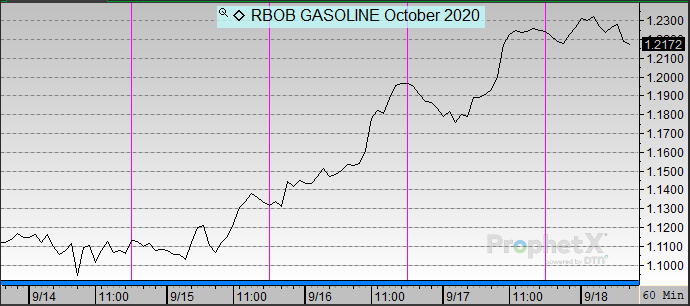

Gasoline opened the week at $1.1076. It followed crude throughout the week to close the week higher. Gasoline opened Friday at $1.2236, a gain of 11.6 cents (10.5%).

This article is part of Daily Market News & Insights

Tagged: Libya, opec, Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.