Natural Gas News – August 17, 2020

Natural Gas Prices Soar As Heat Wave Hits Large Parts Of U.S.

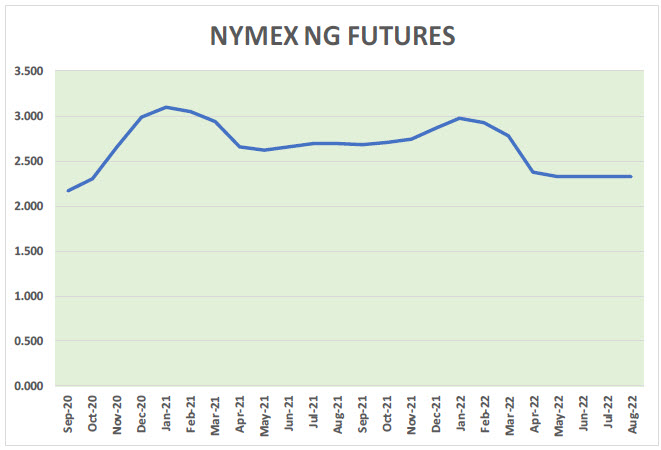

Natural gas prices spiked on Friday by nearly 9%, even as the weekly storage report showed little movement. Natural gas prices hit $2.367 by 2:26

pm EDT, an increase of 8.48% or $0.185, even as the EIA’s weekly storage report a day earlier showed a small increase of 58 Bcf in working gas in storage. The market had anticipated a larger build. Also bullish for natural gas on Friday were forecasts for hot weather and reports of increased LNG exports. Front-month natural gas futures on Friday hit their highest since the end of last year on this data as air conditioning usage is expected to increase as people try to cope with the heat wave. This will increase the demand for natural gas. This will be particularly true in Texas, where demand for power in general—and consequently natural gas—is expected to hit a record high today as the heatwave sets in, according to Reuters. For more on this story visit oilprice.com or click https://bit.ly/348pbck

American Natural Gas Helps Power Anheuser-Busch’s Transition to Renewable Natural Gas in Houston and St. Louis

Industry-leading alternative fuel provider, American Natural Gas (ANG), announced today its support of one of the country’s largest brewers, Anheuser-Busch, as the company continues to implement carbon reduction strategies in its supply chain by transitioning more than 180 delivery

trucks in its Houston and St. Louis dedicated fleets to Renewable Natural Gas (RNG), one of the cleanest burning fuels available. As part of Anheuser-Busch’s ongoing commitment to sustainable logistics, ANG currently fuels more than 80 delivery vehicles headquartered in Dallas and Houston, TX with Compressed Natural Gas (CNG). For more on this story visit prnewswire.com or https://prn.to/343TxwN

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.