Draws Across the Board Lift Markets

On Tuesday, WTI Crude followed US equites to close lower. Earlier in the session, crude and equities had been trading higher on news of slowing coronavirus cases being reported in the US, but falling technology stocks dragged the S&P 500 to close the day lower and crude followed suit.

WTI Crude inventories had a large draw for the third week in a row. In addition, products also had decreasing stock as reported by the API. WTI Crude tested the highs in intraday trading yesterday but has been range bound for many weeks. If EIA numbers support a bullish inventory stance, the top end of the range could be tested again today. The API inventory numbers are pulling the market higher in early trading this morning.

The API’s data last night:

The API reported a larger-than-expected draw for crude of 4.0 MMbbls versus an expected draw of 2.9 MMbbls. At Cushing, stocks increased by 1.1 MMbbls. The API reported that distillates had a decrease in stocks. Gasoline inventories fell more than expected. The EIA will report numbers later this morning.

The EIA reports from the STEO: “EIA expects high inventory levels and surplus crude oil production capacity will limit upward price pressures in the coming months, but as inventories decline into 2021, those upward price pressures will increase. EIA estimates global liquid fuels inventories rose at a rate of 6.4 million barrels per day (b/d) in the first half of 2020 and expects they will decline at a rate of 4.2 million b/d in the second half of 2020 and then decline by 0.8 million b/d in 2021.”

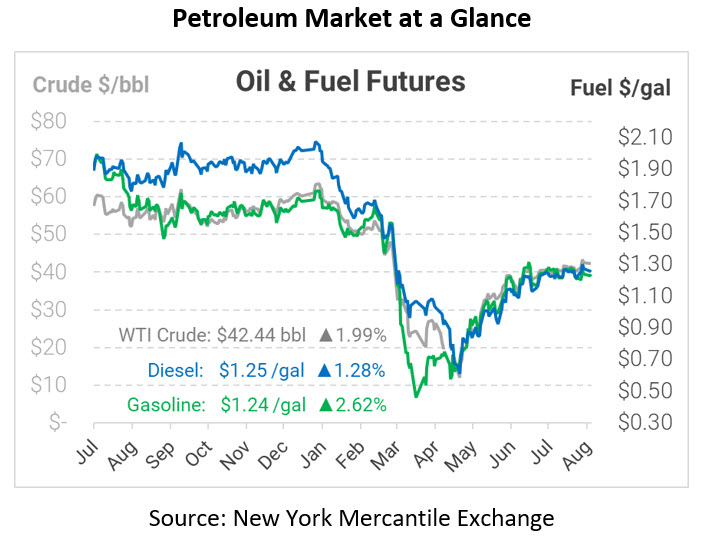

Crude prices are up this morning. WTI Crude is trading at $42.44, a gain of 83 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.2543, a gain of 1.6 cents. Gasoline is trading at $1.2361, an increase of 3.2 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.