Natural Gas News – August 10, 2020

U.S. rapidly shutting coal in favor of natural gas

Since 2010, utilities have retired or announced the closure of more than 500 coal fired power plants in the U.S. This has taken more than 100GW of coal-fired generating capacity out of the American electricity mix. About one-fifth of those closures were facilities either converted to or replaced by natural gas-fired plants, according to a new report from the U.S. Energy Information Administration. The EIA’s data shows that 121 U.S. coal-fired power plants were repurposed to burn other types of fuel between 2011 and 2019. More than 100 retired plants were converted or replaced by gas-fired generation, representing close to 30GW of replacement capacity. The decision for plants to switch from coal to natural gas was driven by stricter emission standards, low

natural gas prices and more efficient new natural gas turbine technology, according to the EIA. Combined-cycle gas turbine (CCGT) plants accounted for 15.3GW of that replacement. For more on this story visit powerengineeringint.com or click https://bit.ly/30IJQSf

Rising Export Expectations, Warm Weather Lift Natural Gas ETFs

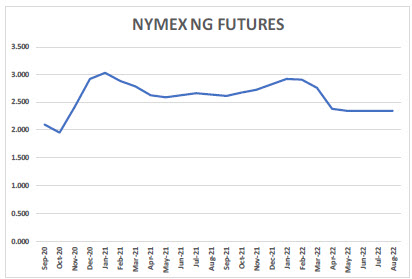

Natural gas prices and related exchange traded funds burned brighter on Friday as improving global demand helped fuel expectations on liquefied natural gas exports and warm weather in the U.S. bolstered electricity demand for cooling. The United States Natural Gas Fund rose 4.0% Friday as Nymex natural gas futures advanced 2.9% to $2.23 per million British thermal units. Asian spot liquefied natural gas prices increased to a more than four-month high this week as prices firmed in Europe and the United States, Reuters reports. For more on this story visit etftrends.com or https://bit.ly/3fHtWM3

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.