Large Crude Draw Moves the Market Higher

On Tuesday, WTI Crude closed higher on news of a large inventory draw reported by the API. Crude prices continue to rise in early trading today on the bullish inventory news as traders await confirmation from the EIA later this morning. The crude rally would seem to indicate inventory data is being weighted more heavily than fears of sagging demand amid a resurgence of coronavirus cases and renewed lockdowns.

The draw in gasoline may show personal travel returning to more normal levels, while the build in diesel may indicate shipping and commercial transportation has still not recovered fully. U.S. Gasoline supplied to the domestic market averaged 7.2 mmbpd in May, an improvement on 5.8 mmbpd month over month, but still down -24% compared to the same month last year.

The API’s data last night:

The API reported a larger-than-expected draw for crude of 8.6 MMbbls versus an expected draw of 3.3 MMbbls. At Cushing, stocks increased by 1.6 MMbbls. The API reported that distillates had an increase in stocks. Gasoline inventories fell more than expected. The EIA will report numbers later this morning.

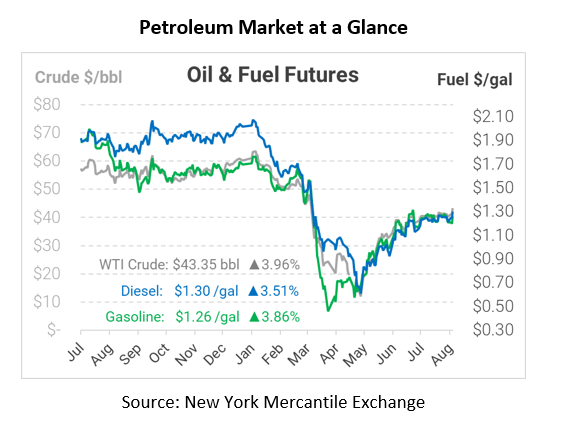

Crude prices are up this morning. WTI Crude is trading at $43.35, a gain of $1.65.

Fuel is up in early trading this morning. Diesel is trading at $1.3026, a gain of 4.4 cents. Gasoline is trading at $1.2612, an increase of 4.7 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.