US-China Tensions Flare, Tropical Storms Forming

Oil prices are trading sideways this morning to close out a relatively uneventful week, at least from a pricing standpoint. Thursday saw prices turn lower across financial markets amid continued coronavirus fears.

In geopolitical news, China has forced the closure of a US consulate in Chengdu, after America demanded the country close its Houston consulate. While US-China tensions are nothing new, markets are afraid that souring relations could scuttle the Phase 1 trade deal both countries signed earlier this year. Amidst the worst economic environment since World War II, even a hint of a trade war would be disastrous for global markets.

US markets are closely watching storms brewing in the Gulf of Mexico. Tropical Storm Hanna (remember when H-name storms didn’t come until October?) has now formed into a named storm, and is on track to hit southern Texas as a weak tropical storm on Saturday. Attracting more attention is Tropical Storm Gonzalo, which is tracking northward a few hundred miles off the South American coastline. While the storm is still too far away to predict accurately, models show a possibility of it tracking over Caribbean islands before pushing towards the US Gulf Coast. For the next few days, the storm will remain a tropical storm, but strengthening could happen. Many speculate whether this will be the first major storm for fuel markets this year.

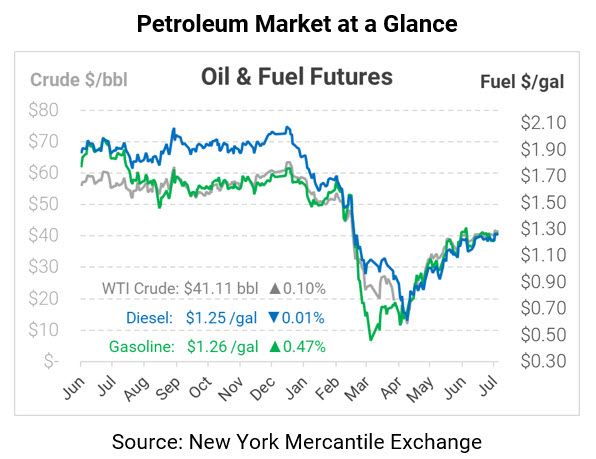

With little news around the world to spur changes, crude oil prices are keeping relatively flat. WTI Crude is trading at $41.11 currently, hardly changed from Thursday’s close.

Fuel prices are also seeing minimal changes. Diesel is $1.2540, unchanged from Thursday’s closing price. Gasoline is trading at $1.2645, up a meager 0.6 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.