With Demand Rising, OPEC+ Considers Easing Cuts

On Tuesday, WTI Crude started the morning strongly but dipped in the afternoon session to close the day 1.5% lower. Crude prices are up in early trading this morning on bullish inventory news from the API of a much larger-than-expected draw in crude stocks. Traders are taking the report as a signal of rising demand.

OPEC+ is considering easing record oil production cuts in August. Global oil demand seems to be recovering, and prices have bounced back from record lows this quarter. There have been no discussions about extending the historic cuts into August, and an extension of the cuts seems unlikely unless there is a downward movement in demand.

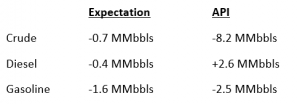

The API’s data last night:

The API reported a draw for crude of 8.2 MMbbls versus an expected draw of 0.7 MMbbls. At Cushing, stocks increased by 0.2 MMbbls. The API reported that distillates had an increase in stocks. Gasoline inventories fell more than expected. The EIA will report numbers later this morning.

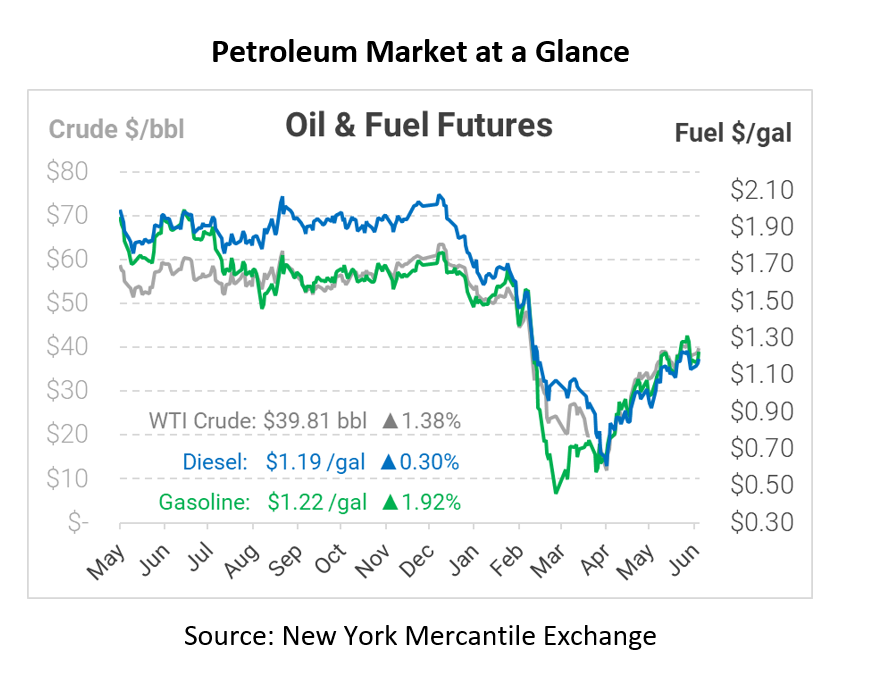

Crude prices are up this morning. WTI Crude is trading at $39.81, a gain of 54 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.1901, a gain of 0.4 cents. Gasoline is trading at $1.2246, a gain of 2.3 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.