US Economy Officially in Recession

The National Bureau of Economic Research’s Business Cycle Dating Committee announced on Monday that the US officially entered a recession in February. The downturn, caused by the coronavirus pandemic, led economic activity to fall sharply. This decline is the first since 2009, when the last recession ended, and marks the end of the longest expansion — 128 months — in US history.

Although the label comes as no surprise, it highlights the severe contraction in GDP occurring in the US and around the world. The World Bank reported yesterday that the global economy will contract by 5.2% this year – the deepest recession since World War II. Additionally, the group points out that developing economies could contract by 2.5%, their first contraction in over 60 years. While the stock markets is in high spirits currently, the world is struggling to overcome the massive hurdle presented by COVID-19.

Yesterday, WTI crude fell sharply as Saudi Arabia announced on Monday that the Kingdom and its allies Kuwait and the United Arab Emirates would not extend their additional 1.18 MMbpd production cuts above the OPEC+ production cuts in July. They had previously been cutting production beyond their OPEC+ quotas to help balance the markets.

Markets are also considering the impact of Libyan oil production coming to markets. Libya is ready to begin exports of crude produced at two of its largest oilfields again after they had been halted for five months, as the North African country’s conflict-ravaged output begins to come back online.

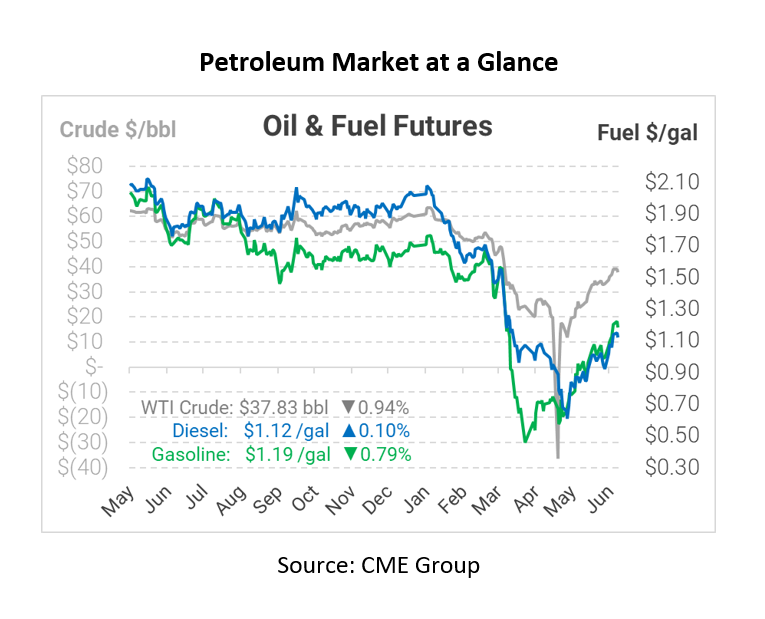

In early trading today, crude prices are down. Crude is currently trading at $37.83, a loss of 36 cents.

Fuel prices are relatively flat this morning. Diesel is trading at $1.1224, a gain of 0.1 cents. Gasoline is trading at $1.1856, a loss of 0.9 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.