Week in Review – June 5, 2020

WTI crude is headed for its sixth straight week of weekly gains after OPEC+ reached a tentative agreement to extend its record production cuts. After a week of discussions, Saudi Arabia and Russia finalized a deal with Iraq regarding quota compliance, opening a way to production cut extensions into July. OPEC+ plans to meet on Saturday to sign off on the final plan. The bullish production news is helping to lift markets in early trading this morning.

Midweek, markets took a hit based on EIA data, which reported an astonishing 9.9 MMbbl build in diesel inventories along with a 2.8 MMbbl build for gasoline inventories. While crude oil stocks fell, the massive product built rattled the market. The inventory gains are even more surprising considering refinery utilization levels in the low-70% range, a substantial deviation from normal May levels around 90-95%. While the economy is reopening and demand is returning to normal, there clearly is not enough demand to soak up even heavily-reduced supply levels.

BP, Occidental Petroleum, and other oil companies are scrambling to evacuate oil platforms in the Gulf of Mexico ahead of the storm moving in the waters. Cristobal, the third named storm of the season is building up steam in the warm gulf waters as it makes its way toward landfall next week – possibly in Louisiana. Gulf Coast refineries are bracing for the storm and are ready to begin implementing hurricane protocols, expecting the worst on Sunday.

Prices in Review

WTI Crude opened the week at $35.21. It tracked higher to start the week but fell mid-week on bearish inventory news. The OPEC+ agreement gave oil markets momentum heading into the weekend, re-starting the rally started earlier in the week. Crude opened Friday at $37.33, a gain of $2.12 (6.0%).

Diesel opened the week at $1.0320 and generally followed crude throughout the week. Diesel opened Friday at $1.0716, a gain of 4.0 cents (3.8%).

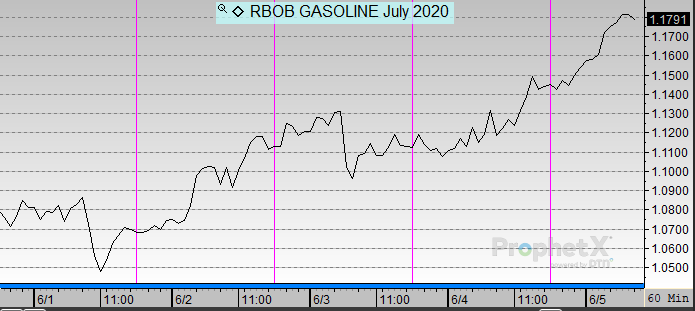

Gasoline opened the week at $1.0312, and followed a steady upward track throughout the week. A meager inventory build failed to contain the rally midweek, pushing gasoline gains ahead of other oil products. Gasoline opened Friday at $1.1428, a gain of 11.2 cents (10.8%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.