Trump to Cut China Out of US Supply Chains

After the first weekly gains in a month, oil markets are still rising despite the latest news on COVID-19. This week, that news is less about health than about politics. Last week, President Trump threatened to impose tariffs on China as punishment for allegedly hiding early information on the COVID-19 threat. This week, the aggressive stance toward China continues. The Trump administration is “turbo-charging” efforts to permanently alter supply chains to rely less on China and more on friendlier nations, according to the undersecretary of Economic Growth, Energy and Environment Keith Krach. Moreover, the US is beginning to form an “Economic Prosperity Network” with trusted economic partners.

Expect turbulent markets this week as various economic releases show just how bad April was for the US (and global) economy. This week’s payroll report is expected to show another 2 million jobs lost in the US; most reports will likely reflect similar dismal news. On the positive end, ISM’s manufacturing index fell by less than the market expected, and construction spending is beginning to inch higher.

Strengthened prices this morning may be a response to OPEC’s cuts going into effect, along with declining US oil production. Saudi Arabia appears to have pumped record amounts of crude in April, but those levels should fall now to comply with the OPEC+ agreement. In addition, Baker Hughes rig count data show US rigs falling to the lowest levels since July 2016. Exxon Mobile and Chevron announced planned shut-ins of 400 kbpd each in the US, mostly in the Permian.

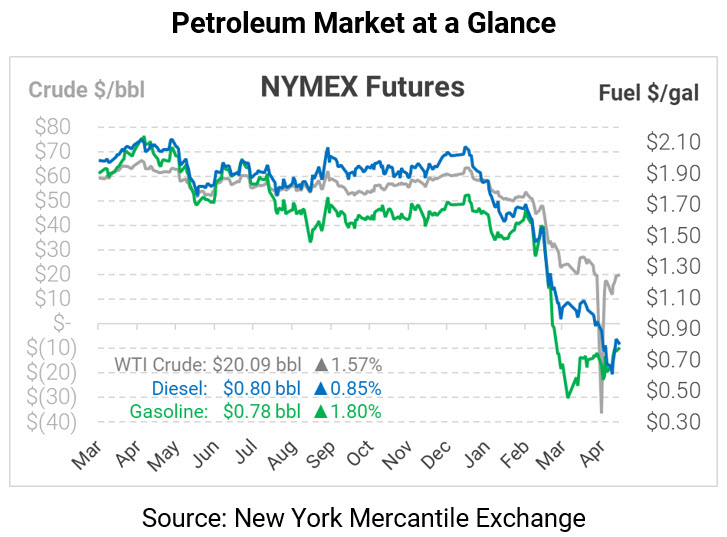

Crude oil prices began the day in negative territory, but have since turned positive in anticipation of economic recovery and OPEC+ cuts. WTI crude is trading at $20.09 this morning, up 31 cents (1.6%) from Friday’s closing price.

Fuel prices are also trading in the black. Despite gasoline’s premium over diesel for most of last week, diesel has regained the upper-hand, though the spread is narrowing. Diesel prices are up to $0.8029, a gain of 0.7 cents (0.9%) from Friday’s close. Gasoline prices are $0.7801, up 1.4 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.