Trump Pledges Support for Oil Industry

On Tuesday, WTI Crude future’s May contract rebounded from -$37.63 to expire in positive territory at $10.01. WTI Crude continues to underperform against Brent crude as we see the price spread widen due to tight storage capacity at Cushing. WTI crude is up in early trading on this first morning of trading for the June futures contract.

President Trump has tasked his Energy Secretary, Dan Brouillette and his Treasury Secretary Steven Mnuchin to devise a plan to assist the struggling US oil and gas industry. The president pledged support for the failing industry via Twitter but did not elaborate on how much funding would be made available or who would be eligible for assistance. In addition to direct government funding assistance, the idea of asking Congress for funding to buy more oil to fill the Strategic Petroleum Reserve was also discussed. Trump stated that it would be a good time to buy oil for the SPR. If Congress does not buy now, they could still rent out the 75 million barrels of available storage space to oil companies desperate for additional storage.

The API’s data last night:

The API reported a large build in stocks across the board. The API reported a smaller-than-expected build for crude of 13.2 MMbbls versus an expected build of 15.2 MMbbls. At Cushing, stocks rose with a build of 4.9 MMbbls. The API reported that gasoline had a smaller-than-expected build and distillates had a larger-than-expected build. The EIA will report numbers later this morning.

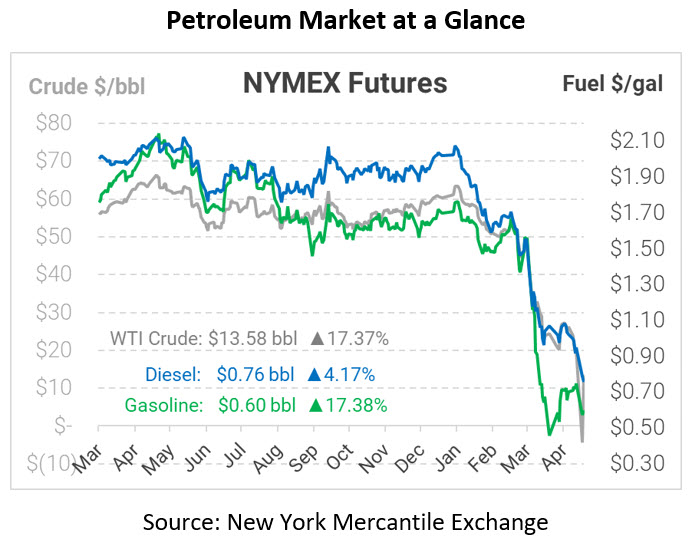

Crude prices are up this morning. WTI Crude is trading at $13.58, a gain of $2.01.

Fuel is up in early trading this morning. Diesel is trading at $0.7572, a gain of 3.0 cents. Gasoline is trading at $0.5990, a gain of 8.9 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.