Week in Review – April 17, 2020

The crude market was down for the week. The week began with what would appear to be bullish news for the market – the OPEC+ group agreed to historic 9.8 MMbpd production cuts for the next two week, followed by large cuts that extend through mid-2022. But amid a 30 MMbpd demand loss, OPEC+’s cuts were a drop in the bucket. Markets had hoped for a deeper short-term cut and reacted to the historic deal with lower prices.

Mid-week, the IEA forecasted a record 29 MMbpd decline in global oil demand due to the COVID-19 pandemic quarantine efforts, and a 9.3 MMbpd full-year demand drop relative to 2019. The EIA also reported a record weekly build in US inventories of 19.2 MMbbls for last week, putting further downward pressure on crude markets to close the week.

As the US economy seeks ways to reopen to stem the tide of unprecedented unemployment and demand destruction, the oil industry is feeling the pain. Retail gasoline demand is down roughly 50%, and some markets have seen wholesale gasoline prices under 20 cents per gallon. The market is facing an unparalleled challenge, which will inevitably cause business pressure.

Consumers who are still in business are taking advantage of historically low prices, locking in fixed prices for future fuel demand. With oil prices at 18-year lows, business consumers are confident that today’s low prices offer a good value for fixed price, keeping fuel expenses low for years to come.

Prices in Review

WTI Crude opened the week at $24.60. It followed a general downward trend throughout the week. Crude opened Friday at 20.00, a loss of $4.60 (-18.7%). Crude is trading considerably lower in early trading this morning.

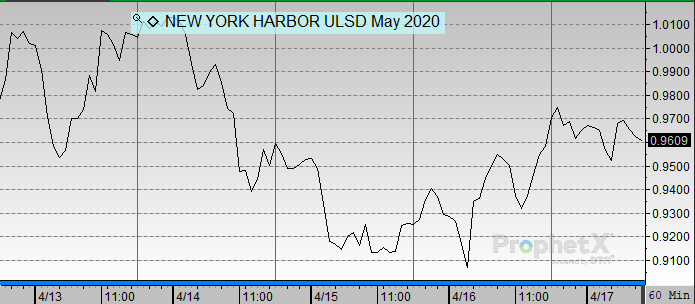

Diesel opened the week at $1.0176. It had a choppy week with ups and downs but ended the week lower. Diesel opened Friday at $0.9619 a loss of 5.6 cents (-5.5%).

Gasoline opened the week at $0.7329. It was up and down through the week ending just slightly lower. Gasoline opened Friday at $0.7135, a loss of 1.9 cents (-2.6%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.