Many Suppliers Consider Contributing to Supply Cuts

Yesterday, crude oil began lower but rallied somewhat in the afternoon on news of improved sentiment in broader financial markets after the reported death tolls in some of the virus hotspots in Europe showed signs of easing. Crude is moving higher in early trading this morning on signs the world’s biggest producers are moving toward a deal to call off their price war. It was reported that Dan Brouillette, the US Energy Secretary, held a “productive discussion” over the phone with Prince Abdulaziz bin Salman, his Saudi counterpart.

According to the leader of the Russian sovereign wealth fund, Kirill Dmitriev, OPEC+ is close to finding a resolution in negotiations around a supply cut. Brazil, Canada and Norway, and other countries have proposed that they may go along with supply cuts if others do so. (Reuters)

Russia has never built large storage facilities as have the US and Saudi Arabia. This leaves them susceptible to an oversupply situation caused by the coronavirus pandemic’s demand destruction. If the US, Saudi Arabia, and Russia cannot come to an agreement regarding voluntary cuts soon, Russia may have to reduce output anyway as it runs out of storage space. (Bloomberg)

While OPEC + meets on Thursday to discuss unprecedented supply cuts, Trump told reporters in Washington that free markets in the US would lead to supply cuts in the US: “I think the cuts are automatic if you are a believer in markets,” he said.

In other news, a notable price increase in urea in the US will impact DEF prices in Q2. Since the primary ingredient in DEF is urea, the urea price change equates to roughly a 3 cent per gallon increase in DEF.

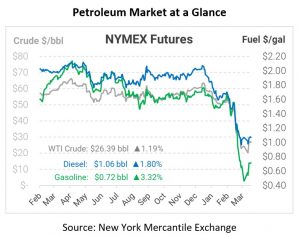

In early trading today, crude prices are continuing their upward trend. Crude is currently trading at $26.39, a gain of 31 cents.

Fuel prices are up today. Diesel is trading at $1.0645, a gain of 1.9 cents. Gasoline is trading at $0.7249, a gain of 2.3 cents.

This article is part of COVID-19

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.