Week in Review – March 27, 2020

The crude market was up slightly for the week. The major news moving markets this week started with the Fed announcing plans to buy $250 billion in mortgage backed securities and $375 billion in Treasuries this week. The Fed action was meant to energize the economy but seemed to have the opposite effect on equities.

Moving markets higher was the news of a $2 trillion stimulus package agreed to this week. The package is the largest ever seen before and includes direct payments to individuals as well as money for small and big businesses affected by the coronavirus lock down.

Jobless claims topped 3.2 million this week. We’ve never seen weekly jobless claims at these levels before – they are more than 4 times greater than the prior high set in October 1982 and double the 1.5 million forecast. Market seemed to gloss over these statistics and moved higher after the news was announced. Perhaps the unemployment news was overshadowed by the recent stimulus package agreement.

Prices in Review

WTI Crude opened the week at $22.52. It was up and down through the week but started by closing higher three days in a row and then falling off. Crude opened Friday at $23.29, a gain of 77 cents (3.4%).

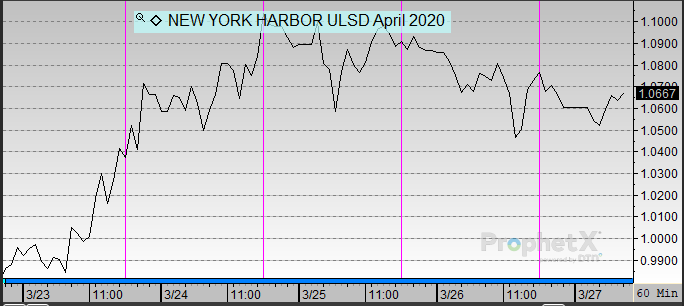

Diesel opened the week at $1.0060. It climbed upward toward mid-week but fell to close the week. Diesel opened Friday at $1.0782, a gain of 7.2 cents (7.2%).

Gasoline opened the week at $0.6050. It dropped precipitously to start the week but rose steadily through the week. Gasoline opened Friday at $0.5713, a loss of 3.4 cents (-5.6%).

This article is part of COVID-19

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.