Trader Sentiment Starting to Turn Again

After three consecutive days of gains, crude prices are down in early trading this morning. Delays in passing a $2 trillion emergency stimulus package to bolster the economy against the standstill caused by the coronavirus have weakened traders’ resolve. The demand destruction caused by the virus has overshadowed the expectations for emergency stimulus to save the day.

According to Goldman Sachs research, demand will fall by 10.5 mmbpd in March and by 18.7 mmbpd in April. Product inventories are therefore expected to surge in the next few weeks, causing further refinery utilization cuts and inventory backing up in the crude market.

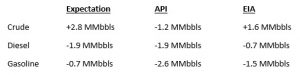

Yesterday, weekly data on US inventories showed minimal effects from the coronavirus pandemic so far. The EIA reported a smaller-than-expected build for crude of 1.6 MMbbls, versus an expected build of 2.8 MMbbls. At Cushing, the EIA reported a 0.9 MMbbls build. The EIA reported distillates had a smaller-than-expected draw and gasoline had a larger-than-expected draw.

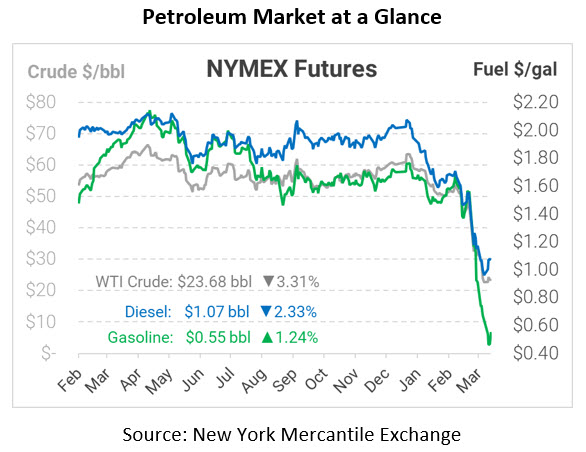

WTI Crude is trading higher this morning at $23.68, a loss of 81 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $1.0722, a loss of 2.6 cents. Gasoline is trading at $0.5536, a gain of 0.7 cents.

This article is part of Coronavirus

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.