No End in Sight for Oil Price War

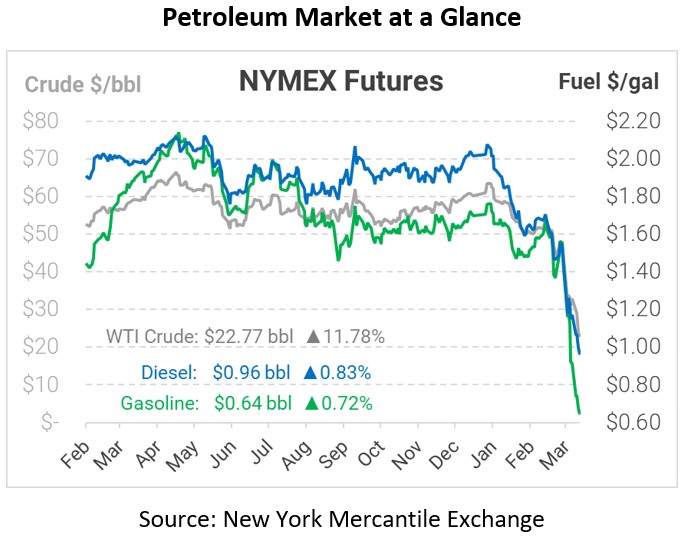

A sell-off over the last three days had taken the market for WTI crude near $20/bbl. The falling demand due to the coronavirus and the oil price war between Saudi Arabia and Russia have driven prices down. Yesterday crude followed equities lower to new lows that had not been matched since 2003. Oil prices have bounced back in early trading this morning.

Saudi Arabia announced it is still planning to keep pumping at a record rate of 12.3 mmbpd for the next few months. (Reuters) This news comes despite Russian spokesman Dmitry Peskov conceding yesterday that Russia would prefer higher oil prices, but also indicating no plans to re-engage Saudi Arabia.

With dozens of shale oil and gas drillers and services companies facing possible bankruptcy, senators on Wednesday urged Saudi Arabia and Russia to stop the price war during talks with the kingdom’s envoy to Washington. (Reuters) The senators told President Trump to impose an embargo on oil from the two countries.

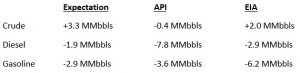

Weekly data on US inventories showed minimal effects from the coronavirus pandemic so far. The EIA reported a smaller-than-expected build for crude of 2.0 MMbbls, versus an expected build of 3.3 MMbbls. At Cushing, the EIA reported a 0.6 MMbbls build. The EIA reported distillates and gasoline had larger-than-expected draws.

Louisiana announced yesterday it is waiving the Reid Vapor Pressure requirements until May 1, 2020. While normally fuel suppliers must switch to low-emission, summer blend gasoline by April 1, the waiver enables refiners and suppliers to continue selling cheaper winter blend gasoline for an additional month. With gasoline demand falling rapidly, the waiver ensures there will be ample time to deplete existing inventories of winter gasoline in Louisiana. Other states may issue similar waivers in the coming weeks.

WTI Crude is trading higher this morning at $22.77, a gain of $2.40.

Fuel is up in early trading this morning. Diesel is trading at $0.9621, a gain of 0.8 cents. Gasoline is trading at $0.6423, a gain of 0.5 cents.

This article is part of COVID-19

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.