U.S. biomass-based diesel tax credit renewed through 2022 in government spending bill

Source EIA

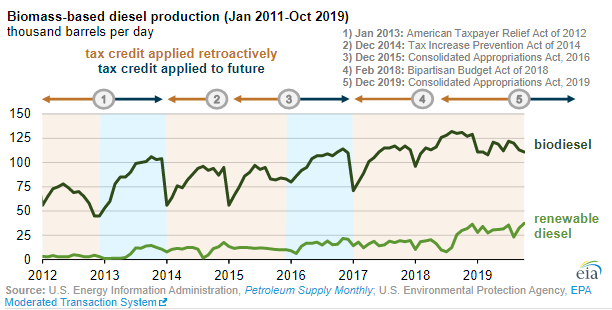

The U.S. government spending bill signed into law in late December 2019 included several provisions related to federal energy programs. Among these provisions was the reinstatement of a $1.00 per gallon biodiesel mixture credit, commonly referred to as the biodiesel tax credit (BTC). The BTC applies to both biodiesel and renewable diesel (referred to as biomass-based diesel) through 2022. The credit was also retroactively applied to 2018 and 2019.

The BTC was created under the American Jobs Creation Act of 2004 and has been amended over time. In its current form, qualified taxpayers may claim the tax credit, at $1.00 per gallon, when the required amount of biodiesel or renewable diesel is blended with petroleum diesel for sale or use in a trade or business.

Congress has extended or retroactively applied the BTC five times since 2011. The tax credit supports higher levels of biodiesel and renewable diesel consumption by offsetting the higher cost of these fuels relative to petroleum-based diesel fuel. In years when the tax credit was in effect during the time of production (i.e., not applied retroactively), such as in 2013 and in 2016, domestic production and foreign imports of biodiesel increased significantly relative to the preceding years.

For example, domestic biodiesel production reached 110,000 barrels per day (b/d) in December 2016, a record at the time and 33% more than in December 2015. Biodiesel imports also reached an all-time high of 86,000 b/d in December 2016. The tax credit was not in place during 2017 but was later retroactively applied as part of the Bipartisan Budget Act of 2018.

At the request of Congress, the U.S. Energy Information Administration (EIA) occasionally calculates the fiscal effects of certain energy-related subsidies. The most recent of these reports, conducted for fiscal year 2016, showed that the fiscal impact of the BTC was $2.7 billion in fiscal year 2016, up from about $550 million in fiscal year 2010. The cost to taxpayers of the $1.00 per gallon tax credit has increased over time as the federal biodiesel requirement for biomass-based diesel and advanced biofuel has grown.

In its January 2020 Short-Term Energy Outlook, EIA expects that the tax credit will contribute to increased levels of both domestic production and net imports of biomass-based diesel through 2021. EIA expects domestic biodiesel production will increase from 119,000 b/d in 2019 to 135,000 b/d in 2020 and 158,000 b/d in 2021. Net imports of biomass-based diesel averaged an estimated 23,000 b/d in 2019, and EIA expects biomass-based diesel net imports to increase to 28,000 b/d in 2020 and to 39,000 b/d in 2021.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.