Week in Review – January 31, 2020

The crude market was down for the week. The major news driving markets this week continues to be the Coronavirus coming from China. The World Health Organization has declared a global emergency but has reassured the world that it is confident that China can contain the virus. The sickness has stoked the fear that people will travel less or stop travelling all together which would affect oil and products demand. Nearly 10,000 cases have been reported worldwide including human to human transmission outside of China.

OPEC is considering pushing forward a meeting initially scheduled for March after oil prices dropped on concern that the spread of coronavirus would hurt oil demand. OPEC will consider continuation of current cuts and possibly even deeper cuts to support a balanced market.

Prices in Review

WTI Crude opened the week on Tuesday at $53.70. OPEC Jawboning and positive sentiment regarding the containment of the coronavirus helped to lift the market as the week began. Bearish inventory news mid-week and the announcement of a global health emergency by the WHO pushed markets lower. However, crude prices jumped at the end of the day yesterday, after the World Health Organization said there is no need for travel and trade bans due to the coronavirus. Crude opened Friday at $52.92, a loss of 78 cents (-1.5%).

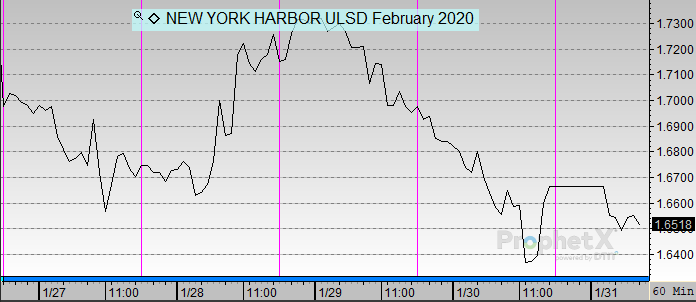

Diesel opened the week at $1.7276. It generally followed crude through the week, but bearish inventory news had an outsized impact. Diesel opened Friday at $1.6550, a loss of 7.3 cents (-4.2%).

Gasoline opened the week at $1.5049. It went counter to crude with a build up to mid-week and a smaller drop off to end the week and a larger jump to close Thursday. Gasoline opened Friday at $1.5225, a gain of 1.8 cents (1.2%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.