US-China Sign Phase-One Trade Deal

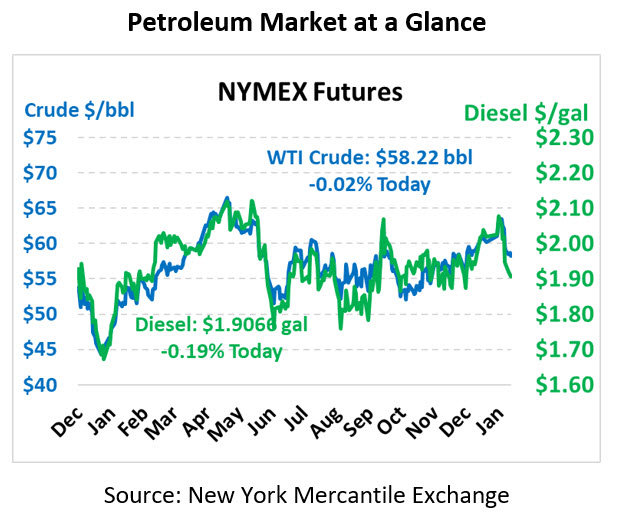

Crude prices are relatively flat this morning. WTI Crude is trading at $58.22, a loss of one cent.

Fuel is flat and mixed in early trading this morning. Diesel is trading at $1.9066, a loss of 0.4 cents. Gasoline is trading at $1.6580, a gain of 0.4 cents.

President Trump and Chinese Vice Premier Liu He are slated to sign an initial trade deal this morning that aims to vastly increase Chinese purchases of US manufactured products, agricultural goods, energy and services. Beijing will reportedly boost energy purchases by some $50 billion over 2 years, compared to a 2017 baseline of US exports to China. While the move will support American oil prices, the overall price affect will be moderated by flexible global supply chains that will merely re-route product to fill any supply or demand gaps.

The agreement also includes stricter enforcement of intellectual property rights and prevents forced technology sharing for US companies. The deal averts tariffs on $160 billion of Chinese goods, while also halving 15% tariffs on $112 billion of Chinese goods. Still, 25% tariffs remain in effect on a hefty portion of Chinese goods. Crude markets appear cautious, and much of the good sentiment may have been priced into the market already.

Crude markets are also evaluating OPEC+ considerations of extending supply cuts until June and pushing their upcoming March meeting to June. This news comes on the heels of Middle East tensions that had only a fleeting impact on markets. OPEC+ is weighing weak oil demand and increasing crude inventories versus continued supply cuts. Speculations did little to sway markets, especially in light of a bearish API report.

The API’s data last night:

The API reported a surprise build for crude of 1.1 MMbbls versus an expected draw of 0.5 MMbbls. At Cushing, stocks fell with a draw of 0.1 MMbbls. The API reported distillates had a larger-than-expected build and gasoline had a build in line with estimates. The EIA will report numbers later this morning.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.