De-escalation and Inventory News Drive Markets Lower

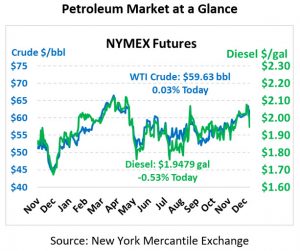

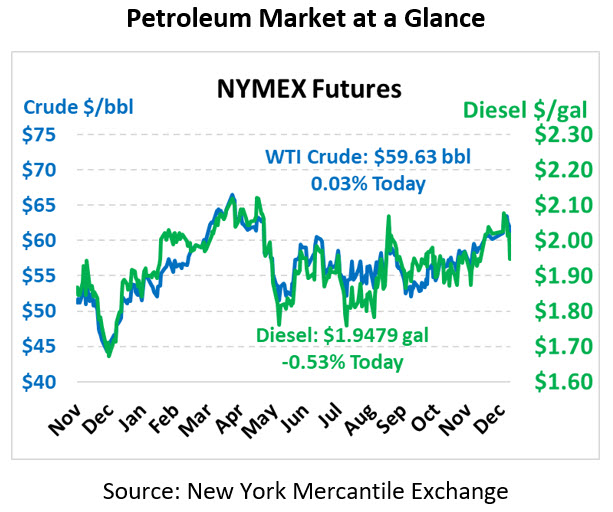

WTI crude oil prices settled yesterday at the lowest levels since December 12th to close at $59.61, a loss of $3.09 (-4.9%). WTI Crude is trading sideways this morning at $59.63, a gain of 2 cents.

Fuel is mixed but relatively flat in early trading this morning. Diesel is trading at $1.9479, a loss of 1.0 cents. Gasoline is trading at $1.6547, a gain of 0.6 cents.

On Wednesday, crude prices fell as it became evident that Iranian rockets did not harm any Americans. Both the US and Iran backed away from days of angry rhetoric to defuse the crisis rather than escalate over the killing of Iranian military commander Qassem Soleimani. Putting further downward pressure on prices was a bearish inventory report by the EIA.

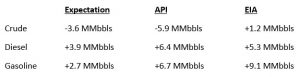

The EIA reported a surprise build for crude of 1.2 MMbbls, versus an expected draw of 3.6 MMbbls. At Cushing, the EIA reported a 0.8 MMbbls draw. The EIA reported distillates had a larger-than-expected build and gasoline also saw a larger-than-expected build.

In other news, demand for so-called heavy-sweet oil like Pyrenees has surged in recent months due to IMO 2020, which took effect Jan. 1. The new rules have boosted the value of these crudes that are low in sulfur and also viscous, which makes them better for marine engines. Since IMO 2020 went into effect, some shippers have noticed fuel quality issues such as low sulfur fuel oil (LSFO) causing engine damage. As LSFO demand rises we may see more engine trouble requiring more blending of distillates.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.