Middle East Instability Rises, Markets Brace for Iran Retaliation

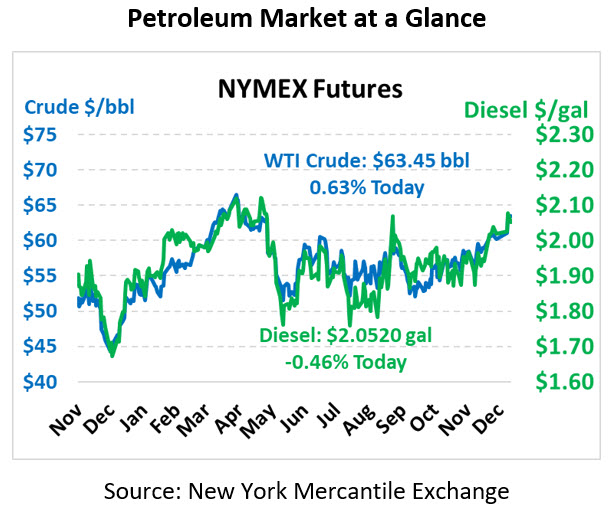

Mere days after the US killed an Iranian General travelling in Iraq, Middle East tensions are already beginning to heat up. On Friday, oil prices soared to $2/bbl gains, and this morning those increases are continuing steadily. Crude oil is currently trading at $63.45, up 40 cents from Friday’s close.

Fuel prices are mixed this morning. Diesel prices are trading at $2.0520, down almost a penny from Friday’s close as the market prices in a large inventory build. On the other hand, gasoline prices are trading at $1.7650, up 1.6 cents.

What’s the Latest from Iran?

The Middle East is turning into a tinderbox of instability, and oil prices are caught up in the blow-by-blow. Today marks the last day of Iran’s mourning period for their fallen general, and US forces are on high alert for retaliation. US troops in Iraq have transitioned from fighting ISIS to securing military bases ahead of an attack.

Iran has also fully withdrawn from the nuclear agreement, meaning they could develop nuclear capabilities in less than a year. Ever since the US pulled out of the deal in May 2018, European and Asian countries have been fighting to keep Iran in the deal, though sanctions made that quite difficult. Now, Iran has announced they will no longer comply with any restrictions in the treaty, though stopping short of formally withdrawing from its mechanisms.

This announcement represents perhaps the most dangerous escalation so far. Iran’s development of a nuclear weapon would force the international community to step in and attempt to prevent proliferation. Analysts have estimated that nuclear breakout could occur within 4-5 months under worst case scenarios. The US and Israel have considered direct strikes on Iranian facilities to prevent nuclear developments – an outright act of aggression that would invite retaliation on US soil.

And in Iraq?

This weekend Iraq’s parliament voted to expel all US troops from the country, though Trump threatened heavy sanctions if the country attempts to follow through on the decision.

As a quick refresher, the Middle East has two dominant sects of Islam – the Sunnis and the Shia, who are generally opposed to each other. Both Iraq and Iran are predominantly Shiite, while US allies such as Saudi Arabia, Egypt, and Turkey are predominantly Sunni. This religious difference helps explain why Iraq is mourning along with Iran and why the country is seeking to expel US troops. It’s also worth noting that ISIS forces are considered a radical Sunni group, which is why Iran and Iraq were repelling their forces, though Saudi Arabia and other Sunni countries have also disavowed the principles of ISIS.

With Iraq and Iran drawing closer together and a response from Iran expected imminently, US forces in Iraq are focusing heavily on security. An attack may come at a base, on US forces abroad, or on military leadership. Trump has already threatened to counterattack if retaliation harms US lives.

Iraq produces 4 MMbpd of oil, roughly 4% of the world’s oil production. With the country under severe threat, markets are pricing in at least some probability of complete collapse and chaos, though a more likely scenario involves a moderate disruption of oil flows that could be offset by Saudi Arabia’s millions of barrels of excess production. While a few US workers have been evacuated from Iraqi oil fields, all production is currently online.

What’s Happening Everywhere Else?

Baker Hughes reported yet another drop in North American rig counts, with the count falling by 7 last week. This continues a broad trend of falling rigs deployed as producers face tougher capital requirements from banks. The EIA released their weekly inventory data on Friday, two days delayed due to the holidays. The massive crude oil draw added support to an already bullish and risk-averse market, keeping prices higher.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.