China’s Crude Imports Hit New Record High

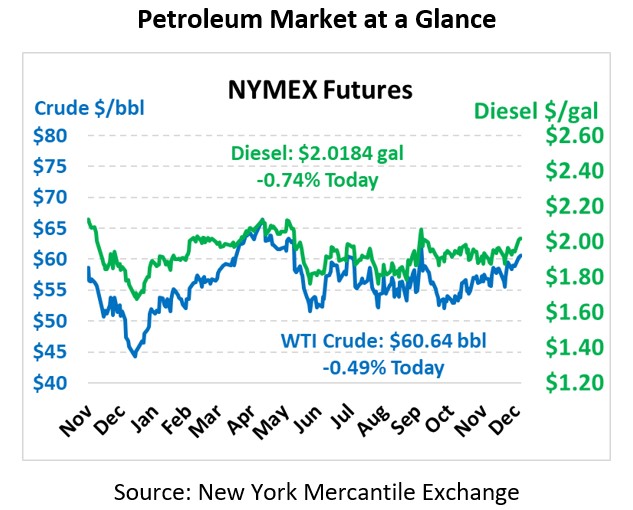

A surprise build reported by the API is driving crude markets lower this morning. WTI Crude is trading at $60.64, a loss of 30 cents.

Fuel is down in early trading this morning. Diesel is trading at $2.0184, a loss of 1.5 cents. Gasoline is trading at $1.6635, a loss of a 2.2 cents.

On Tuesday, crude prices closed higher on market optimism over positive macroeconomic news. Chinese crude oil imports hit a new record high of 11.2 mmbpd in November, surpassing the previous record set by the US in June 2005 at 10.8 mmbpd. Chinese data showed yesterday that industrial output and retail sales growth have accelerated more than expected in November despite the trade war. Still, growth in China is expected to slow further next year, with a government growth target of around 6% in 2020, down from 6.5% earlier this year

The API’s data last night:

The API reported a surprise build for crude of 4.7 MMbbls versus an expected draw of 1.3 MMbbls. At Cushing, stocks fell with a draw of 0.3 MMbbls. The API reported distillates and gasoline had larger-than-expected builds. The EIA will report numbers later this morning.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.