Markets Move on Inventory News and Hope of Supply Cuts

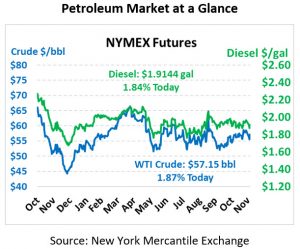

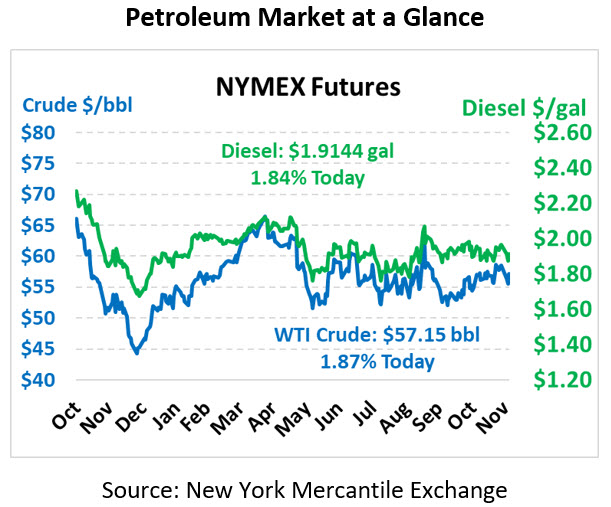

A larger-than-expected draw reported by the API seems to be putting upward pressure on crude markets this morning. WTI Crude is trading at $57.15, a gain of $1.05.

Fuel is up in early trading this morning. Diesel is trading at $1.9144, a gain of 3.5 cents. Gasoline is trading at $1.1.5934, a gain of a 3.0 cents.

On Tuesday, crude prices closed slightly higher after starting the session lower. The markets weighed the expectations of production cuts from OPEC+ against President Trump’s remarks that a trade deal with China could be delayed. We see gains in the market this morning after the API reported a larger-than-expected draw in crude stocks yesterday.

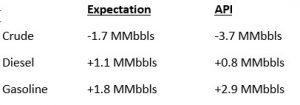

The API’s data last night:

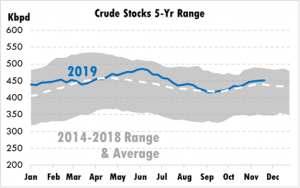

The API reported a larger-than-expected draw for crude of 3.7 MMbbls versus an expected draw of 1.7 MMbbls. At Cushing, stocks fell with a draw of 0.3 MMbbls. We are at the point in the year where the bias is towards shrinking or flat crude inventories. So, seasonally the draw is expected and will keep crude stocks right in line with the five-year average (see chart below). The API reported distillates had a smaller-than-expected build and gasoline saw a larger-than-expected build. The EIA will report numbers later this morning.

OPEC+ continues to send mixed messages on plans for further cuts ahead of meetings this week, as the Joint Technical Committee for OPEC reportedly ended their discussions without any conclusive plans for cut suggestions. Iraq reiterated its plan to deepen cuts and suggested that there was support from “a number of members.” Russia announced the meeting was constructive but added that Moscow had yet to finalize its position.

This article is part of Crude

Tagged: API, eia, fuel, Iraq, Joint Technical Committee, Moscow, opec, President Trump, trade deal with China

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.