Russia Against Deeper Supply Cuts

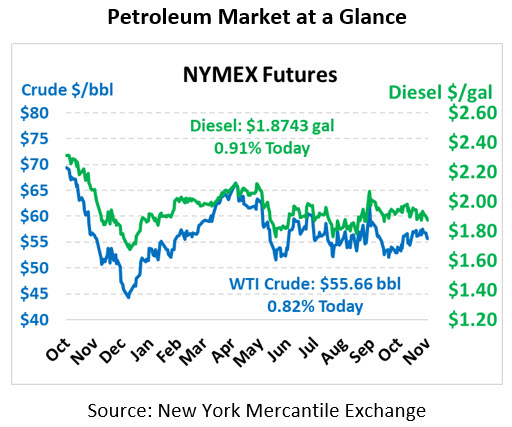

While there was a larger-than-expected build in crude stocks reported by the API, there was a draw at Cushing which seems to be putting upward pressure on prices this morning. WTI Crude is trading at $55.66, a gain of 45 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.8743, a gain of 1.7 cents. Gasoline is trading at $1.6134, a gain of a penny.

On Tuesday, crude prices fell more than 3% after Russian sources said they do not expect deeper cuts at OPEC’s December 3rd meeting. However, Russia stated it could be open to a rollover of the existing agreement. Russia has concerns of giving up market share to US Shale producers and is not as worried about price as are the Saudis. Saudi Arabia’s imminent IPO of Saudi Aramco would benefit from higher oil prices to justify the valuation that has been announced for the IPO of $1.7 Trillion.

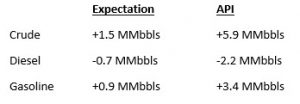

The API’s data last night:

The API reported a larger-than-expected build for crude of 5.9 MMbbls versus an expected build of 1.5 MMbbls. At Cushing, stocks fell for the second week in a row with a draw of 1.4 MMbbls. The API reported distillates had a larger-than-expected draw and gasoline saw a larger-than-expected build. The markets are awaiting confirmation from EIA data coming out later this morning.

This article is part of Crude

Tagged: API, IPO, opec, Russia, Saudi Arabia, Saudi Aramco, US Shale producers

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.