Trade Deal Progress Dims

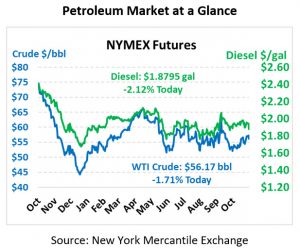

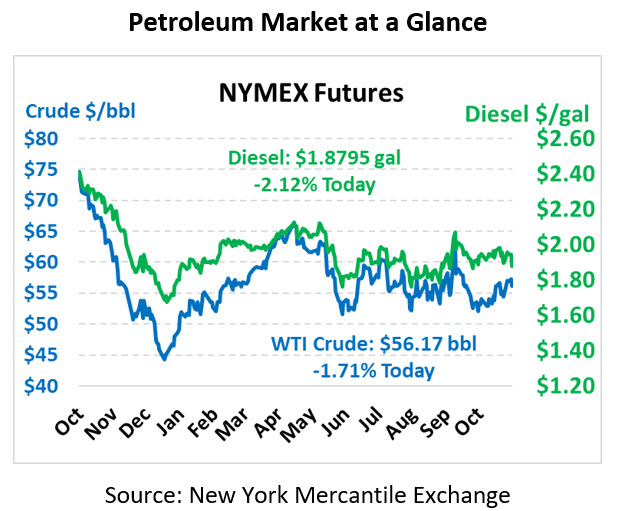

After rising to the highest point since September yesterday, crude markets retreated while retaining 80-cent gains. Today, those gains have been shed. Crude oil is currently trading at $56.17, down 98 cents (1.7%) from Thursday’s close.

Fuel prices are down as well, with diesel leading the complex lower. Diesel prices are trading at $1.8795 this morning, down 4.1 cents (-2.1%). Gasoline prices are $1.6064, down 2.9 cents (-1.8%).

Supportive comments regarding a US-China trade deal are now bringing up new questions. Chinese authorities commented that the two countries had agreed to a process for phasing out tariffs over time, but now US comments suggest there are still issues to be resolved. Continued delays in negotiations continue to tax the global economy at a time when many countries are already showing weakness. Some had speculated that Phase 1 might be completed and signed as early as this month – recent comments suggest negotiations may take more time.

OPEC showed increased exports for October following Saudi Arabia’s quick production recovery in September. A few countries exceeded their quotas, leading Saudi Arabia to once again push for countries to bring their output into compliance. With Saudi Aramco’s IPO now in the forward view, expect Saudi Arabia to be a strong advocate for tighter production and higher prices. The group is expected to review markets in December to see if steeper cuts are required to keep prices elevated.

This article is part of Crude

Tagged: fuel prices, trade deal, US-China

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.