Unemployment at Record Low, IMO 2020 Pressures Diesel

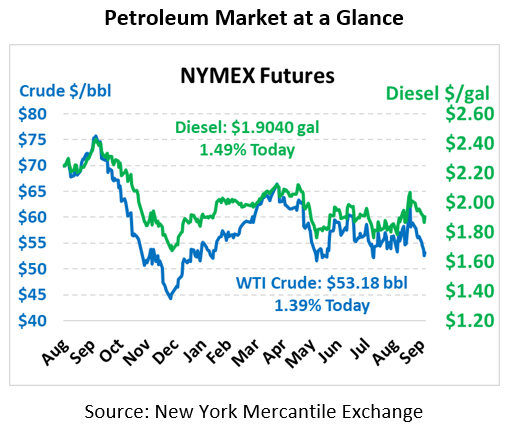

Oil prices are creeping higher this morning after a long streak of down days. Markets have closed lower for the past eight days, so pay attention to see if prices continue sinking today. The longest streak of down days in NYMEX WTI Crude history was 12 straight sessions, a record set just a year ago in October-November 2018. Crude oil is currently trading at $53.18, up 73 cents from yesterday’s close.

Fuel prices are trading higher as well. Diesel prices are currently trading at $1.9040, up 2.8 cents. Gasoline prices are $1.5824, up 2.7 cents.

Weak economic data this week has caused a fright for markets, but today brings more positive news. We’ve already talked about the manufacturing data this week, which came in below expectations. Today’s payroll data also showed job growth coming in below expectation, but the unemployment rate surprisingly dropped to a new 50-year low of 3.5%. Regardless of the monthly data though, the falling business and consumer sentiment could prove an overwhelming challenge for the global economy. As one investment chief put it, “There’s probably a 1 in 4 chance we have a recession just because of the confidence freeze.”

In IMO 2020 news, Merrill Lynch is holding to their forecast of tight diesel markets over the next few months, which can already be seen in inventory levels. The bank estimates that diesel demand could rise by roughly 1 million barrels per day due to the regulatory change, more than offsetting weaker demand. In fact, the bank estimates inventories could fall as low as 2008 levels, when HO spreads soared above $30/bbl. Compared to current prices, with HO-Brent spreads around $21, that represents roughly 20 cents in diesel price upside over the next few months.

This article is part of Crude

Tagged: demand, global economy, IMO 2020, job growth, Merrill Lynch, NYMEX, prices, recession, unemployment rate

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.