Trump Decreases Trade Optimism

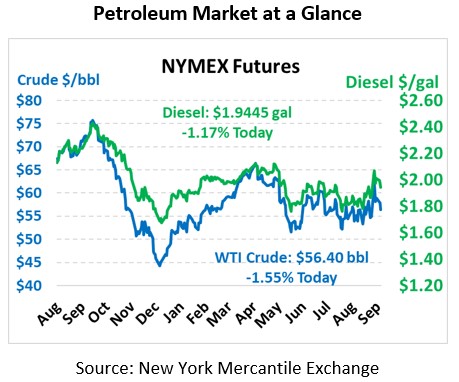

Trump’s rhetoric in the trade war with China drove markets lower yesterday and today. WTI Crude is trading at $56.40, a loss of 89 cents.

Fuel is also trading lower this morning. Diesel is trading at $1.9445, a loss of 2.3 cents. Gasoline is also lower this morning, trading at $1.6265, a loss of 2.9 cents.

President Trump was a factor in market movement once again as he gave a speech at the UN decreasing optimism over China-US trade talks. He denounced unfair trade practices and said he would not accept a “bad deal” from China. Trump’s trade rhetoric, in addition to weak economic growth data from Europe and Japan, and a bearish API report put downward pressure on the markets.

The API’s data last night was:

The API reported a surprise 1.4 MMbbls build versus an expected small draw. At Cushing, the organization sees oil stocks rising for the first time in twelve weeks with a build of 2.3 MMbbls. These factors helped to drive prices lower yesterday and today. The build is particularly surprising in the wake of the large Saudi outage last week, though US inventories may be more isolated than those in other countries. The EIA report coming out later this morning will likely set the trading tone for the remainder of the week.

In Europe, Britain, Germany, and France, backed the United States in blaming Iran for the attack on Saudi oil infrastructure this month. They urged Tehran to try and come to the table for new talks. Despite this recent news, Trump was dovish on Iran in his U.N. speech. He stated there is a path to a peace for Iran.

This article is part of Crude

Tagged: API, China, decrease, Trade Optimism, trade talks, trade war, Trump, UN

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.