What to Watch in Crude Inventories

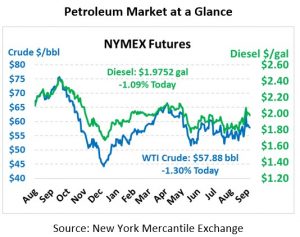

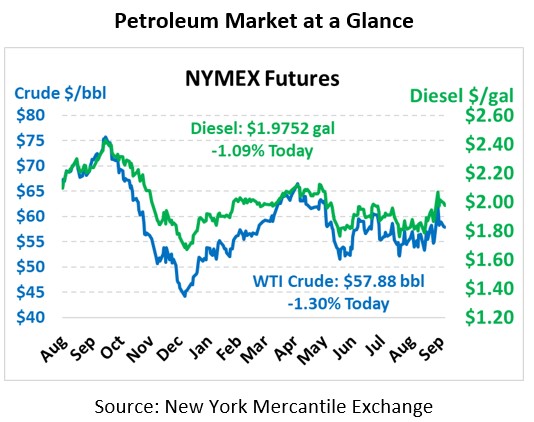

Oil has traded within a $58-$59 range for a week now following the Saudi attacks last week. While that’s on the high end of 2019’s $50-$60 range, there has not been a marked break above the range, highlighting how flexible markets have become over the last few years as American oil has dominated the global supply arena. This morning the market continues to see moderate activity. Crude oil is currently trading slightly below this past week’s range at $57.88, down 76 cents.

Fuel prices are following crude lower as well. Diesel prices are currently $1.9752, down 2.2 cents from Monday’s closing price. Gasoline prices are $1.6525, down 3.1 cents.

Markets are back to focusing on trade and the economy, particularly as agriculture comes under focus in US trade talks. Headlines from Saudi Arabia have been jerking markets around a bit, but without a clear direction. If you’re tired of hearing about Saudi Arabia and China, though, today’s article will be a nice break for you.

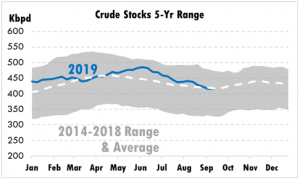

This afternoon will bring an updated inventory report from the API, while the EIA will post their inventory data tomorrow. Crude oil markets typically peak around March or April, falling throughout the summer before restocking in the fall. Based on that trend, the next few weeks will be very important for supplies throughout the winter.

This year brought an inventory anomaly. Inventories kept rising clear through June rather than stopping in April, peaking at a whopping 485 million barrels, 40 million barrels above the seasonal average for that time of year. Since then, markets have drawn down rapidly. For the last two weeks, inventories have been slightly below the five-year average.

We’ve reached the point in the year when crude inventories typically begin rising again. Given how long it took to stop building inventories, it will be interesting to see whether stocks revert to their normal patterns, or if crude’s withdrawal season extends as late as the injection season. The former scenario would help keep prices moderated this winter, while the latter could present some tough challenges as the industry prepares for IMO 2020. Keep your eyes on the EIA inventory reports over the next few weeks – they may prove particularly influential for the next few months of fuel prices.

Crude stocks 5 yr range 2014-2018

This article is part of Crude

Tagged: crude inventories, EIA inventory, IMO 2020, oil trading, Saudi attacks, stocks

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.