While Saudis Restart, US Gulf Refiners Shut Down

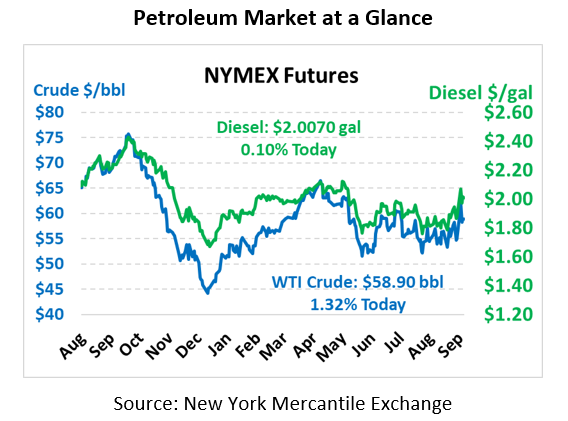

Markets are still uncertain about the implications of the attack on Saudi Arabia. As the country continues restarting its crude and refined product processing capabilities, much remains offline. The country announced that one refinery’s 300 kbpd output would be shut for maintenance earlier than planned, bringing total offline refining capacity to 950 kbpd. This morning crude oil is trading slightly higher on continued uncertainty and added risk premium. Crude oil prices are currently $58.90, up 77 cents.

Fuel prices are mixed despite clearly bullish refined product outages. Gasoline is trading at $1.6950, down 0.6 cents. Diesel prices are basically flat at $2.0070, barely staying above the $2/gal threshold.

While markets continue pondering the outages in Saudi Arabia, there are troubles much closer to home to consider as well. Tropical Depression Imelda brought some heavy rains to the US Gulf Coast, forcing ExxonMobil’s massive Beaumont refinery to close in its 350 kbpd of output. Total Gulf Coast refining losses are estimated to be one million barrels per day of fuel production.

Two years ago, Hurricane Harvey caused Gulf refineries to shut down 4.4 MMbpd for several weeks, impacting the entire Southeast. The damage this go-round is much smaller but is still a solid reminder of the on-going risk of hurricane activity, especially along the Gulf Coast. Currently in the Atlantic, Hurricane Jerry is expected to curve northeast without hitting land, while three more systems are being investigated for possible development. Mansfield is tracking these storms and will report back as the situation evolves.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.