Markets Expecting OPEC Cut Continuation

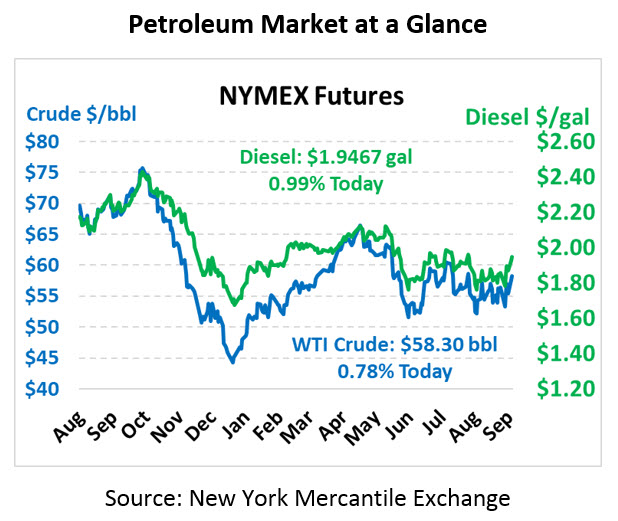

Oil prices have risen to their highest level since late July, drawing support from Saudi Arabia’s new energy minister committing to maintain cuts along with reduced risks of a no-deal Brexit. Crude oil is currently trading at $58.30, up 45 cents from yesterday’s close.

Fuel prices are trading higher as well, with diesel prices rising to levels not seen since July 31. Diesel is currently trading at $1.9467, a gain of 1.9 cents since Monday’s close. Gasoline prices are $1.5960, up 1.1 cents.

Markets are hopeful that Saudi Arabia’s new energy minister, a seasoned OPEC diplomat, will lead the organization to extend production cuts this week. The former minister played a key role in orchestrating OPEC’s cuts but was unable to maintain the higher crude prices Saudi Arabia desired. Markets will watch to see whether the new minister, Prince Abdulaziz bin Salman, can deliver steeper cuts and higher prices. OPEC’s two-day meeting begins tomorrow, and a key agenda item will be whether the group extends production cuts beyond Q1 2020.

In Mexico, President Lopez Obrador delivered his budget to Mexico’s congressional body, which included a 17% increase in oil production to balance budgets, a 300 kbpd increase. Following 15 straight years of declining production, the gains seem more than a tad ambitious, though the government alleges that Pemex’s ability to stabilize declines makes the gains more attainable. If Pemex cannot deliver increased oil output and prices remain low, the Mexican government would be forced to make spending cuts, which could further erode their ability to grow oil production, reducing global supplies in the future.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.